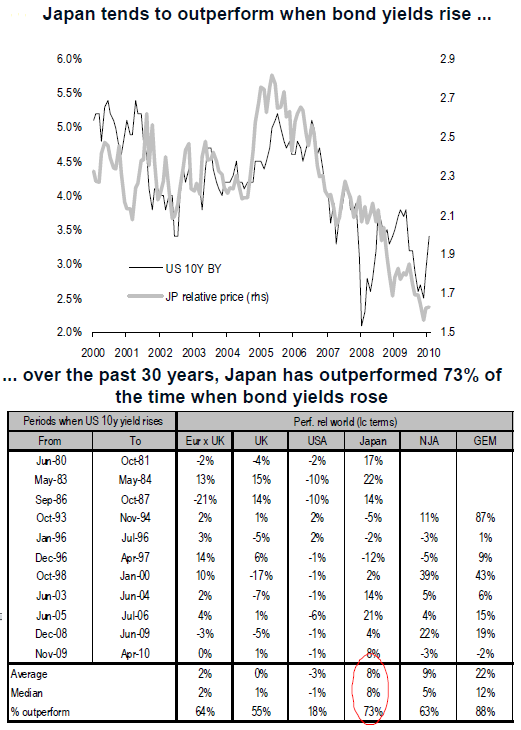

While the average return is certainly impressive, investors would be wise to notice the variation in returns during previous periods. Investors adhering to this strategy between 1993 and 1997 would have found themselves vastly under performing other equity markets around the world. Beyond the above average returns in Japan, the relative under performance of U.S. equity markets noted above is quite striking. During the 11 periods of rising yields over the past 30 years, the U.S. equity market has only increased twice and by a mere 2%. Recently, yields have been rising again and may still be in an upward trend, although they've retreated slightly from the most recent peaks. Therefore, it seems worthwhile to consider how different equity markets have responded during the most recent period of rising yields.

The yield on 10 year treasuries last bottomed on October 8th, 2010 and has since peaked on December 15th, 2010. During that time the benchmark index for the UK, the FTSE 100, rose nearly 4%. The Nikkei 225, Japan's benchmark equity index, gained more than 6.5%, fulfilling the strategy's expectations. However, most surprising is the S&P 500's nearly 6.5% gain in the face of rising yields. Rising yields accompanied by strength in U.S. equity markets clearly breaks away from history. Is this a trend that's likely to continue or a warning sign of a coming correction?

As Credit Suisse describes in their note, the basic investment thesis revolves around rising real yields reflecting improving growth expectations. Previously I've noted that the natural extension of this theory would imply that falling real yields reflect deteriorating growth expectations. Despite this natural extension, falling real yields have been widely heralded over the past year as positive for equity markets and unrelated to growth expectations. If rising yields have now become a positive catalyst for stocks, then it's possible that yields no longer have any reliable effect on equity markets. Another possible explanation is that the Federal Reserve's quantitative easing skews normal market correlations. The Federal Reserve has openly stated it's goal of raising equity markets through its program and therefore the recent trend would be deemed a success, at least in the short-run. A third potential explanation is offered by extreme levels optimism in equity markets leading to gains despite typically negative signals. Under this view, the market likely faces some downside in the near future. Whether or not yields continue to rise may affect the size of any coming correction and ultimately determine if the most recent period is truly an outlier.

No comments:

Post a Comment