During the past week a couple of my friends and family asked whether or not I was considering buying a home in the near future. To give a quick bit of background, I’m approaching (or in) my late 20’s and was recently engaged. I’m also fairly confident in plans to live within the DC Region for at least several more years. Given all of the discussion about home values, interest rates and the American dream, I thought expressing my own views on the current housing market would be helpful.

Based on conversations and reading over the past several months, the general opinion seems to hold that the current environment is the ideal time to purchase a home. As I understand the argument, home prices have fallen significantly and appear to be bottoming. At the same time mortgage rates are near historic lows, which makes servicing debt on a mortgage relatively easier. Both of these observations suggest that now is an opportune time to buy a house. If only the decision were that simple. Deciding if now is a good time requires determining whether or not those assumptions are valid. So are they?

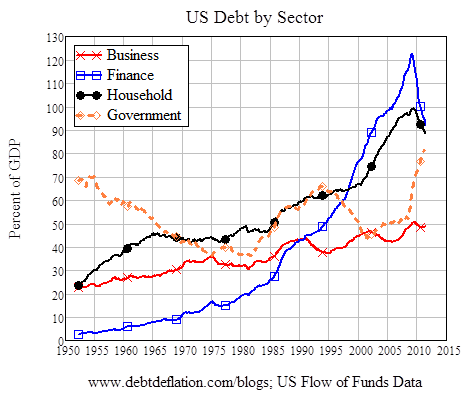

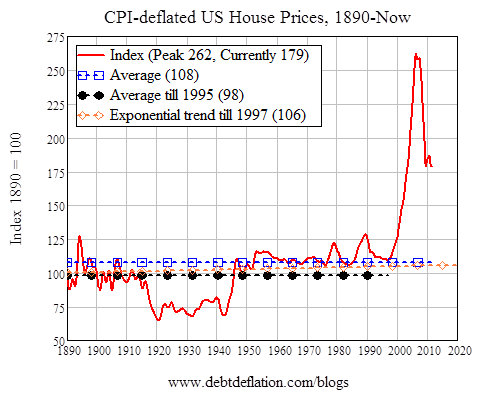

Home prices have certainly fallen significantly in the last few years, but calling a bottom seems pre-mature. Many housing analysts will note that existing home sales have been rising, the supply of homes for sale is shrinking and the number of new homes being built is well below trend. The other side of the story, which often goes untold, is that new home sales continue falling to new lows, data on existing homes for sale is distorted by a potentially large shadow inventory of homes awaiting the foreclosure process, and household debt remains at very elevated levels (see top chart below). For those who have studied previous bubbles in asset markets, prices tend to undershoot historical norms on the downside as well (see bottom chart below). Public policy, to date, has worked hard to maintain home values at elevated prices to reduce any negative wealth effect on consumer demand and prevent greater losses to banks and GSE’s holding underwater mortgages. The future direction of housing policy and home values remains extremely unclear and one cannot rule out further declines of 10%-20%.

Moving on to interest/mortgage rates, it is also true that rates are at or near historically low levels. Mortgages with 30-year fixed rates are currently being offered around 4%. Rates on mortgages generally track the interest rate on US Treasuries with similar maturities, adding a small premium for extra risk of repayment and profit. The rate on US Treasuries is basically the average of expected Fed Funds (short-term) rates over the maturity of the bond (Treasury Yields Low for Good Reason). Determining the future of mortgage rates therefore relies on predicting the future path of monetary policy. On Wednesday the Fed announced expectations that the rate will remain exceptionally low until late 2014, based on forecasts of low inflation and high unemployment. Despite the multitude of people expressing fears about inflation and belief that the Fed will need to raise rates soon (these began in 2009), I continue to hold the view that disinflation remains more prominent in the US (Deflationary Monetary Policy). Based on my outlook for the economy (Predictions for 2012), I expect the Fed to hold interest rates near 0 until at least 2015. Under the corresponding economic environment, long-term interest rates may fall further but are very unlikely to rise. Mortgage rates may very well remain at historically low levels far longer than most people today imagine.

When deciding whether or not to purchase a home, there are certainly a whole host of factors to consider that were not discussed here (family, job security, income, savings/debt, location, etc). The purpose is to provide an alternative prospective to the seemingly common perception that now is the best time to buy and those who fail to act will miss a great opportunity. While I don’t rule out that possibility, I believe the outlook for home prices and mortgage rates suggests this window of opportunity will remain open for a few years. In fact, those who wait may be rewarded with lower mortgage rates and more house for their money. There is no rush to buy a home!

Based on conversations and reading over the past several months, the general opinion seems to hold that the current environment is the ideal time to purchase a home. As I understand the argument, home prices have fallen significantly and appear to be bottoming. At the same time mortgage rates are near historic lows, which makes servicing debt on a mortgage relatively easier. Both of these observations suggest that now is an opportune time to buy a house. If only the decision were that simple. Deciding if now is a good time requires determining whether or not those assumptions are valid. So are they?

Home prices have certainly fallen significantly in the last few years, but calling a bottom seems pre-mature. Many housing analysts will note that existing home sales have been rising, the supply of homes for sale is shrinking and the number of new homes being built is well below trend. The other side of the story, which often goes untold, is that new home sales continue falling to new lows, data on existing homes for sale is distorted by a potentially large shadow inventory of homes awaiting the foreclosure process, and household debt remains at very elevated levels (see top chart below). For those who have studied previous bubbles in asset markets, prices tend to undershoot historical norms on the downside as well (see bottom chart below). Public policy, to date, has worked hard to maintain home values at elevated prices to reduce any negative wealth effect on consumer demand and prevent greater losses to banks and GSE’s holding underwater mortgages. The future direction of housing policy and home values remains extremely unclear and one cannot rule out further declines of 10%-20%.

Moving on to interest/mortgage rates, it is also true that rates are at or near historically low levels. Mortgages with 30-year fixed rates are currently being offered around 4%. Rates on mortgages generally track the interest rate on US Treasuries with similar maturities, adding a small premium for extra risk of repayment and profit. The rate on US Treasuries is basically the average of expected Fed Funds (short-term) rates over the maturity of the bond (Treasury Yields Low for Good Reason). Determining the future of mortgage rates therefore relies on predicting the future path of monetary policy. On Wednesday the Fed announced expectations that the rate will remain exceptionally low until late 2014, based on forecasts of low inflation and high unemployment. Despite the multitude of people expressing fears about inflation and belief that the Fed will need to raise rates soon (these began in 2009), I continue to hold the view that disinflation remains more prominent in the US (Deflationary Monetary Policy). Based on my outlook for the economy (Predictions for 2012), I expect the Fed to hold interest rates near 0 until at least 2015. Under the corresponding economic environment, long-term interest rates may fall further but are very unlikely to rise. Mortgage rates may very well remain at historically low levels far longer than most people today imagine.

When deciding whether or not to purchase a home, there are certainly a whole host of factors to consider that were not discussed here (family, job security, income, savings/debt, location, etc). The purpose is to provide an alternative prospective to the seemingly common perception that now is the best time to buy and those who fail to act will miss a great opportunity. While I don’t rule out that possibility, I believe the outlook for home prices and mortgage rates suggests this window of opportunity will remain open for a few years. In fact, those who wait may be rewarded with lower mortgage rates and more house for their money. There is no rush to buy a home!

No comments:

Post a Comment