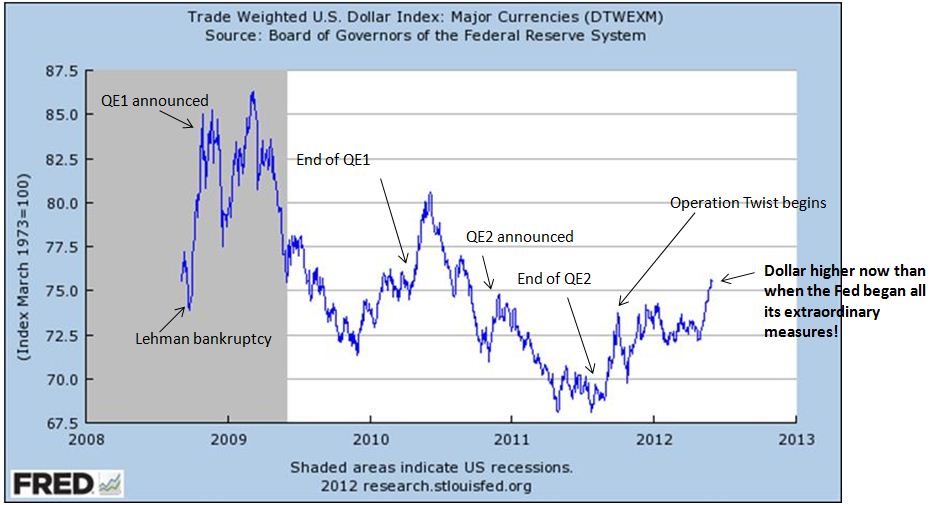

Rising Dollar Ignores Monetary Stimulus

Here’s another fun fallacy quashed! Most mainstream media continues to discuss the Federal Reserve’s easing actions as a means to monetise the debt and/or devalue the US dollar against foreign currencies. This presumption has led many to incorrectly forecast rising or hyper-inflation over the past few years. Well, after two rounds of QE and one round of Operation Twist, the US dollar now resides firmly above its level at the time of the Lehman bankruptcy and the last two attempts at monetary stimulus...

Source: Dollar has gone up since Lehman, QE1, QE2, Op Twist at Mike Norman Economics

Deleveraging by the private sector (and a large current account deficit) continues to negate inflationary pressures stemming from the Fed’s actions and the government deficits. With global growth slowing at an increasing pace, the dollar may still have plenty of room on the upside to run.

No comments:

Post a Comment