David Rosenberg's 2013 Investment Outlook

One of the best resources for investment advice and economic projections over the past several years has been David Rosenberg. Courtesy of Zero Hedge, here is part of his outlook for 2013:

The Fed has also completely altered the relationship between stocks and bonds by nurturing an environment of ever deeper negative real interest rates. Therein lies the rub. The economy and earnings are weak, and getting weaker, but the Interest rate used to discount the future earnings stream keeps getting more and more negative, and that lowers the corporate cost of capital and in turn raises the present value of expected future profits. It's that simple.

...

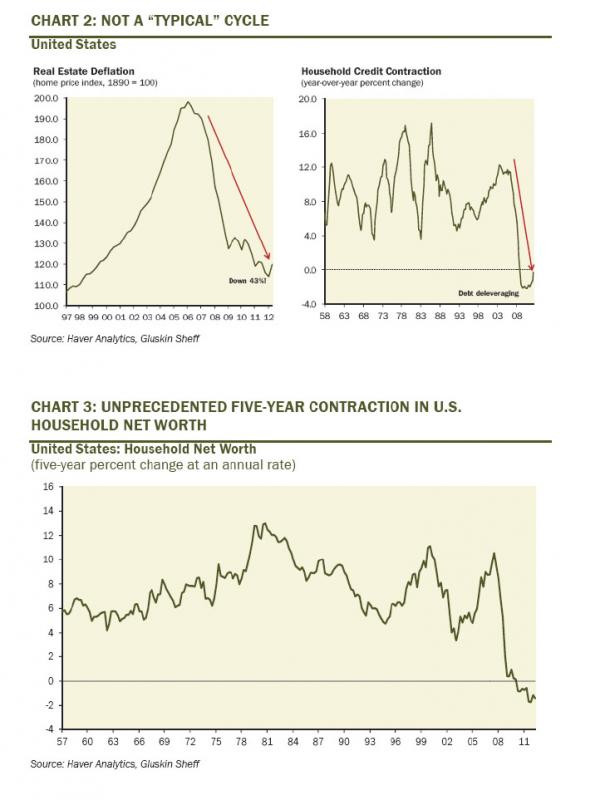

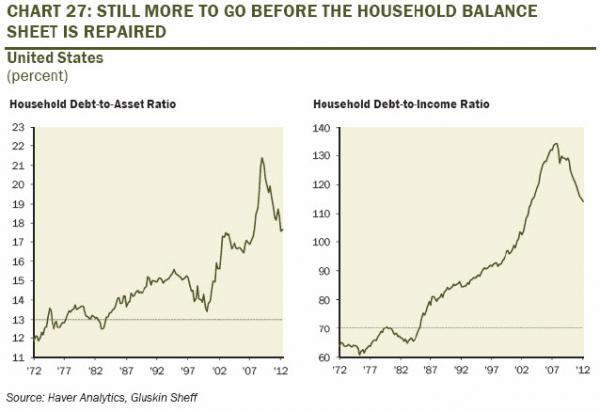

Beneath the veneer, there are opportunities. I accept the view that central bankers are your best friend if you are uber-bullish on risk assets, especially since the Fed has basically come right out and said that it is targeting stock prices. This limits the downside, to be sure, but as we have seen for the past five weeks, the earnings landscape will cap the upside. I also think that we have to take into consideration why the central banks are behaving the way they are, and that is the inherent 'fat tail' risks associated with deleveraging cycles that typically follow a global financial collapse. The next phase, despite all efforts to kick the can down the road, is deleveraging among sovereign governments, primarily in half the world's GDP called Europe and the U.S. Understanding political risk in this environment is critical.

...

With regard to global events, we continue to monitor the European situation closely. Euro zone finance ministers have given Greece an additional two-year lifeline and the Greek parliament just passed another round of severe austerity measures, which I think will only serve to make matters worse there from an economic standpoint, but I doubt that the creditors are going to let Greece go just yet. So this never-ending saga remains a source of ongoing uncertainty, but at the same time. Is a key reason why the Fed and the Bank of Canada will continue to keep short-term interest rates near the floor, and all that means is to build even more conviction over income equity and corporate bond themes.

...

As for something new, after a rather significant slowdown in China for much of this year that put the commodity complex in the penalty box for a period of time, we are seeing some early signs of visible improvement in the recent economic data out of China and this actually has happened even in advance of any significant monetary and fiscal stimulus. And while the Chinese stock market has been a laggard, if there is one country that does have the room to stimulate, it is China (make no mistake, however, China's economic backdrop is still quite tenuous, especially as it pertains to the corporate sector - excessive inventories, stagnant profits, rising costs and lingering excess capacity are all challenges to overcome).

Keep in mind that much of this slowing in China was a lagged response to prior policy tightening measures to curb heightened inflationary pressures - pressures that have since subsided sharply with the consumer inflation rate down to 2% (near a three-year low) from the 6.5% peak in the summer of 2011 and producer prices are deflating outright. What is providing a big assist to this sudden reversal of fortune in China is a re-acceleration in bank lending as a resumption of credit growth and bond issuance has allowed previously- announced infrastructure projects out of Beijing (railways in particular) to get incubated.

The nascent economic turnaround we are seeing in China, if sustained, is Positive news for the commodity complex and in turn resource-sensitive currencies like the Canadian dollar, which I'm happy to report has hung in extremely well this year even in the face of all the global economic and financial crosscurrents. Just consider that the low for the year for the loonie was 96 cents - you have to go back to 1976 to see the last time intra-year lows happened at such a high level.

...

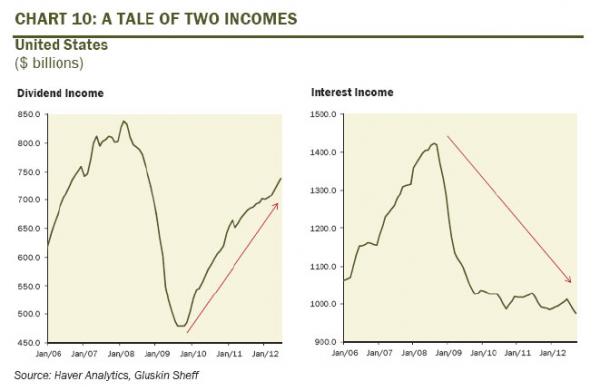

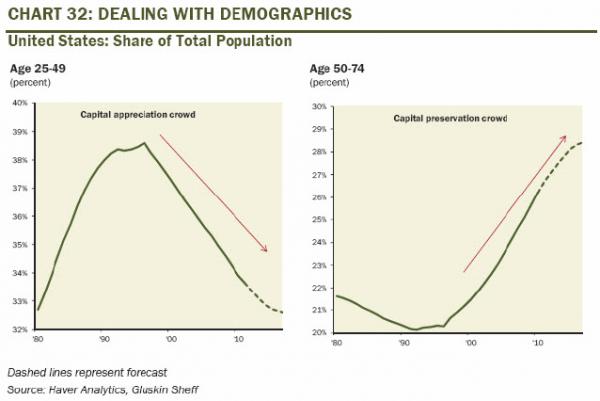

To reiterate, our primary strategy theme has been and remains S.I.R.P. - Safety and Income at a Reasonable Price - because yield works in a deleveraging deflationary cycle.Not only is there substantial excess capacity in the global economy, primarily in the U.S. where the "output gap" is close to 6%, but the more crucial story is the length of time it will take to absorb the excess capacity. It could easily take five years or longer, depending of course on how far down potential GDP growth goes in the intermediate term given reduced labour mobility, lack of capital deepening and higher future tax rates. This is important because what it means is that disinflationary, even deflationary, pressures will be dominant over the next several years. Moreover, with the median age of the boomer population turning 56 this year, there is very strong demographic demand for income. Within the equity market, this implies a focus on squeezing as much income out of the portfolio as possible so a reliance on reliable dividend yield and dividend growth makes perfect sense.

...

Gold is also a hedge against financial instability and when the world is awash with over $200 trillion of household, corporate and government liabilities, deflation works against debt servicing capabilities and calls into question the integrity of the global financial system. This is why gold has so much allure today. It is a reflection of investor concern over the monetary stability, and Ben Bernanke and other central bankers only have to step on the printing presses whereas gold miners have to drill over two miles into the ground (gold production is lower today than it was a decade ago - hardly the same can be said for fiat currency). Moreover, gold makes up a mere 0.05% share of global household net worth, and therefore, small incremental allocations into bullion or gold-type investments can exert a dramatic impact. Gold cannot be printed by central banks and is a monetary metal that is no government's liability. It is malleable and its supply curve is inelastic over the intermediate term. And central banks, who were selling during the higher interest rate times of the 1980s and 1990s, are now reallocating their FX reserves towards gold, especially in Asia. With the gold mining stocks trading at near record-low valuations relative to the underlying commodity and the group is so out of favour right now, that anyone with a hint of a contrarian instinct may want to consider building some exposure - as we have begun to do.

The Fed’s recent actions imply that it will permit inflation to temporarily rise above 2% in the hopes of reducing unemployment and spurring growth at a faster pace. While that occurrence remains to be seen, there is potential for even deeper negative real yields over the coming year to boost stocks further. However, as I’ve been arguing for many months, future earnings growth will likely be much weaker than expected and may turn negative. Last year I offered my own predictions for 2012. In the next couple weeks, I hope to discuss those successes and failures, while also putting forth new predictions for 2013. In the meantime, here are few charts from Rosenberg’s outlook that caught my eye:

People should satisfaction before investing in any business. Risk is must in any business so take risk and invest best to a firm.

ReplyDeleteVCT