Several months ago I wrote (emphasis added):

The Federal Reserve’s decision to implement an “interest-on-reserves regime” has clearly been beneficial in permitting the use of previously conventional measures for unconventional purposes, including the provision of liquidity and “financing” of federal budget deficits. Eliminating the payment of interest-on-reserves will not prevent the Fed from continuing to use open market operations in this manner, as long as the Fed Funds rate remains at zero. However, departing from this new regime will ensure that any future rate hikes be preempted by a reversal of the balance sheet expansion (or excess sale of Treasuries).

…

Given that any decision to cease paying interest-on-reserves would likely be temporary and the potential benefit is limited, there is seemingly little reason for the Fed to change course. An “interest-on-reserves regime” appears likely to rule monetary policy for the foreseeable future.That prognostication, more recently made by Steve Randy Waldman, has generated an intense online debate about monetary operations, base money, the platinum coin and the so-called “permanent floor.” Waldman (also here and here) and Paul Krugman (see here and here) have been the major players, but others including Cullen Roche (see here and here), Scott Sumner (see here and here), Izabella Kaminska, Tim Duy (see here, here, and here), Merijn Knibbe, Ashwin Parameswaran, Greg Ip, and Scott Fullwiler (the foremost expert on the subject) have jumped in the ring. For monetary dorks/nerds, myself included, the discussion has been extremely interesting and illuminating.

Since so much has already been written on the matter, I won’t spend much time recapping the major points of contention. My intent is to highlight a few questions that came to mind while reading but, in my opinion, were not adequately addressed. Hopefully the answers put forth will shed light on areas of the debate that remain dark.

Question(s): Assuming a “platinum coin” example, Paul Krugman says:

“right now it makes no difference: financing the government by selling T-bills with zero yield, and financing it by making a deposit at the Fed, which either adds to the monetary base or sells some of its zero-yield assets, has, um, zero implication for anything except some peoples’ blood pressure.

But what happens if and when the economy recovers, and market interest rates rise off the floor?

There are several possibilities:

1. The Treasury redeems the coin, which it does by borrowing a trillion dollars.

2. The coin stays at the Fed, but the Fed sterilizes any impact on the economy, either by (a) selling off assets or (b) raising the interest rate it pays on bank reserves

3. The Fed simply expands the monetary base to match the value of the coin, an expansion that mainly ends up in the form of currency, without taking offsetting measures to sterilize the effect.”First, does financing the deficit by making a deposit at the Fed add to the monetary base? Second, what impact on the economy does the coin have that requires ‘sterilizing’? Third, if the monetary base expands, will the expansion mainly end up in currency form?

Answer(s): When the Treasury deposits a $1 trillion platinum coin at the Fed, the Fed credits the Treasury’s account with $1 trillion in reserves. These reserves, however, are not counted in the monetary base since the Treasury's account does not count as reserve balances in circulation. The simple action of depositing a platinum coin at the Fed therefore has no direct impact on the economy that would require sterilization*. In fact, the primary (sole?) purpose of this exchange is to allow the Treasury (Congress) to spend without requiring debt sales that would exceed the debt limit. This seemingly harmless subversion of federal spending requirements actually holds great significance regarding the roles of private banking and the Fed in our current monetary system.

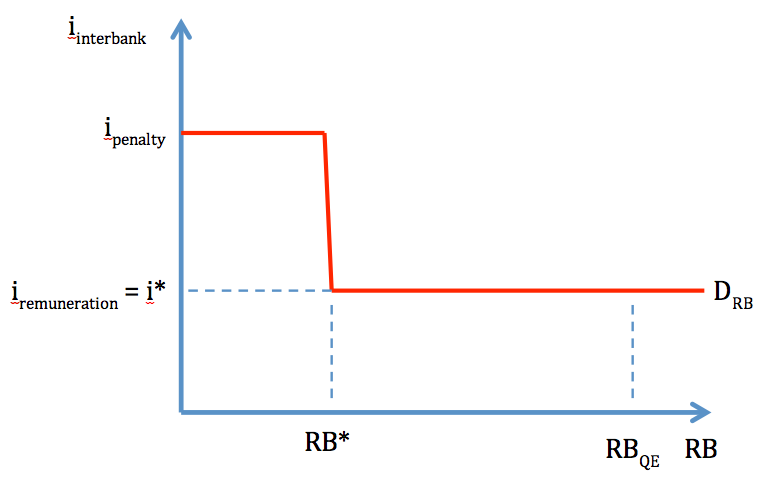

Free from the obligation to sell debt when deficit spending occurs, the Treasury would directly increase the monetary base as spending adds reserves to the private banking system (reserves in circulation). If the Fed was not operating under a “permanent floor” system or at the zero lower bound (ZLB), this would require the Fed to sterilize the effect either through asset sales or debt sales. Since the Fed would have reduced its balance sheet to pre-2008 levels, asset sales would be relatively limited in quantity. The Fed is also legally prohibited from selling its own debt, so it’s seemingly fortunate that the Fed has been permitted to issue time deposits since September 2010 (h/t jck in comments). Aside from the slightly altered roles in affecting the monetary base, it’s important to note that the Fed would become the primary payer of interest in this scenario. Although this has no impact on a consolidated government balance sheet (combining the Treasury and Fed), it would likely require the Fed to either indefinitely operate with negative equity or receive substantial transfers of capital from the Treasury (see forthcoming post on the logistics of Fed ‘insolvency’).

While the Fed’s role and independence is diminished by these actions, the role of private banks could potentially be reduced by far more. With government spending unconstrained by debt sales (and a compliant Fed), the government could subvert the reign of private banks as primary issuers of money. This would drastically reduce the profitability of banks and their power to influence government actions. Recognition of these potentially dramatic changes to the financial system may have provided the impetus for the Fed’s decision to shoot down the “platinum coin.”

Returning to Krugman’s third scenario and the third question mentioned above, let’s assume the Treasury increases the monetary base by spending reserves into the system and the Fed wishes to raise interest rates. If the Fed does not want to operate under a “permanent floor” system, then it must sterilize the monetary base expansion (or remain at the ZLB).

However, if the Fed elects to operate under a “permanent floor” system, then it can raise interest rates by raising the interest rate on reserves (IOR) AND decide whether or not to sterilize the increase in the monetary base. If the Fed chooses not to sterilize, the rising monetary base will consist of either non-interest bearing currency or interest-bearing reserves. Assuming that the expansion “ends up mainly in the form of currency” requires that banks (and individuals) either cannot exchange currency for reserves or prefer a non-interest bearing asset to an interest-bearing one. Since Waldman informs us that “holders of currency have the right to convert into Fed reserves at will (albeit with the unnecessary intermediation of the quasiprivate banking system)” and the latter constraint is irrational (certainly for large quantities), the expansion will almost certainly consist mainly of reserves.

As this post is already bordering on (crossed?) being of excessive length, the remaining questions and answers will be temporarily postponed. Special thanks for their contributions through comments are owed to Scott Fullwiler, JKH, RebelEconomist, Dan Kervick, Ashwin Parameswaran, wh10, Detroit Dan, K, JW Mason, jck and last, but not least, Mike Sax.

*it may indirectly impact the economy by altering expectations

Great summary post!

ReplyDeleteIs there an email I can contact you at? I had a question or two, if you would be willing. I would be happy to leave mine in the URL slot, if it wouldn't be displayed publicly (not sure how it works).

Bubblesandbusts@gmail.com

DeleteThanks!