Shinzo Abe: Monetarist or Keynesian Hero?

A couple weeks back, Tim Duy argued that many economists were missing the big story in Japan:

Ultimately, it is the story of the end game of the permanent zero interest rate policy.

In a follow up post, Duy noted that:

a thread is making the rounds claiming that Japanese Prime Minister Shinzo Abe is all bark, no bite. Joshua Wojnilower argues that Abe is a closet austerian, thus ultimately the actual stimulus enacted will be of the short-term, low-power variety. Noah Smith is less diplomatic, pointing out that Abe's first time at the helm was something of a disaster because Abe fundamentally has a narrow focus:

"I of course don't mean to imply that Abe's cultural conservatism makes him unlikely to experiment with monetary policy (unlike in America, in Japan "hard money" is less of a conservative sacred cow). Instead, what I mean is that Abe really just does not care very much at all about the economy. I mean, of course he wants Japan to be strong, and of course he doesn't want his party kicked out of power. But his overwhelming priority is erasing the legacy of World War 2, with the economy a distant, distant second."

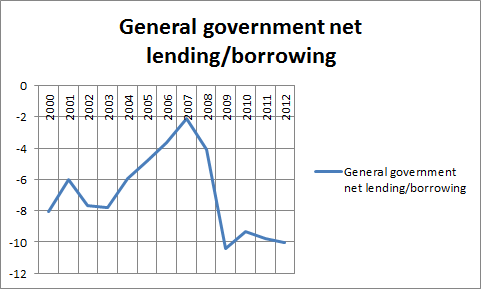

I highlighted the following chart in my previous post:

Abe’s previous leadership entailed the smallest budget deficit during the past 12 years, by a wide margin (Source: IMF):

Although Abe may be willing to accept short-term fiscal expansion this time around, his medium and long term views still seem focused on reducing public debt.

Now Abe’s government is following through with a $116bn stimulus package that sent the Nikkei shooting higher and pushed the Yen even lower. Supposedly:

the stimulus will boost Japan’s economy by 2% and create 600,000 jobs.

Has the Monetarist hero suddenly become a New Keynesian icon? For the time being, maybe so, but I maintain my reservations about the mid-to-long term stimulative plans of this government. Fortunately, for me, Noah Smith also remains pessimistic given Abe’s and the LDP party’s history of waste and favoritism accompanying stimulus measures:

Anyway, the tweaked electoral system, lower "clientelist" pork spending, and the disastrous unpopularity of Abe's first tenure as prime minister helped ushed the DPJ into power, breaking the LDP's 55-year run. But now the LDP is back, and they need to re-establish their base of support. This means re-establishing the back-scratching relationship with those construction firms (and, by extension, rural Japan, right-wing Tea Party type groups, and the mafia). The LDP needs to say "Hey, guys, things are back to the way they were." This, I suspect, is the main reason for the "emergency stimulus".

…

To sum up: Once again, I think that Abe's appearance as a bold Keynesian experimenter is a cover for a program of traditional mercantilism and corporatism. I guess we'll see how well that program works.

Interesting stuff, Josh. Krugman however has pointed out that since the Summer inlfation expectations have shot up in Japan along with the drop in the Yen.

ReplyDeleteSo its not unreasonable to at least ask if the long term deflationary spiral of Japan is ending.

http://krugman.blogs.nytimes.com/2013/01/12/worthwhile-japanese-initiative/

I just saw that post from Krugman and here were my initial thoughts...

DeleteKrugman shows inflation expectations have been rising but not that actual inflation has changed at all. I wonder how many times in the past twenty-plus years inflation expectations have risen temporarily only to fall once the 'inflationary' policies prove ineffective. I'd also be curious how correlated inflation expectations or real interest rates in Japan have been with actual inflation, GDP growth or unemployment.

My guess is that the current situation has played out inn Japan several times before and hence the fact we're still discussing it suggests little reason for optimism.

This reminds me of a paper called "Permanent and Transitory Policy Shocks" by Kozicki and Tinsley: //www.frbsf.org/economics/conferences/0403/kozicki_rwp03-09.pdf

ReplyDeleteAbe is insisting on a 2% inflation target, but there is uncertainty about whether it is for the short run or the long run--transitory or permanent. The paper gives some theory for that situation.

Thanks for reading suggestion. I'll definitely take look. Beyond whether or not the inflation target is permanent or transitory, I still have doubts about the ability of QE to meet that target.

Delete