The Impossible Trinity (also known as the Trilemma) is a trilemma in international economics which states that an economy cannot simultaneously maintain a fixed exchange rate, free capital movement, and an independent monetary policy. This principle was initially derived from the Mundell-Fleming model, also known as the IS-LM-BoP model. Although the model was first outlined by Mundell and Fleming 50 years ago, to this day it continues to play a significant role informing public policy. For this reason it also remains a staple of Ph.D. programs, even those that generally despise Keynesian economics.

While many students may accept the model’s conclusions based on its longevity and the professions’ widespread adherence (which may be wise), I was naturally skeptical. What are the model’s assumptions? Will different monetary regimes alter the conclusions? What does it even mean to have “an independent monetary policy”? In search of answers, I sought out one of the original sources.

“Capital Mobility and Stabilization Policy under Fixed and Flexible Exchange Rates” by R.A. Mundell was published in The Canadian Journal of Economics and Political Science all the way back in November 1963. At the time the world’s major industrial nations were adhering to the Bretton Woods system, under which the U.S. dollar was convertible to gold and all other countries involved tied their currencies to the U.S. dollar. Recognizing the expansion of global trade taking place, Mundell sought to outline “the theoretical and practical implications of the increased mobility of capital. (p.475)” To simplify the conclusions Mundell begins by assuming “the extreme degree of mobility that prevails when a country cannot maintain an interest rate different from the general level prevailing abroad. (p.475)” He further assumes “that all securities in the system are perfect substitutes” and therefore the “existing exchange rates are expected to persist indefinitely. (p.475)” The last assumption presently worth noting is that “Monetary policy will be assumed to take the form of open market purchases of securities. (p.476)”

While these assumptions may have been valid within the Bretton Woods system, that system was terminated in 1971 by President Nixon unilaterally canceling the direct convertibility of the U.S. dollar to gold. Since then the U.S. and several other major industrial nations have been operating using a fiat currency. Under this new monetary regime, without convertibility, there is little reason to believe that all currencies are even near perfect substitutes or that exchange rates will persist for any defined period of time. Furthermore the end of the Bretton Woods system marked the beginning of inflation targeting as the primary method of monetary policy.

Monetary policy was still enacted through open market operations after the regime change, but those operations were now performed to maintain an target interest rate. The more significant difference is that using interest rates as the primary tool for targeting inflation ensured interest rates would be maintained at levels different from those prevailing abroad. This “corridor” system of inflation targeting would last in the U.S. for nearly 40 years before being replaced by a “permanent floor” system in 2008.

Breaking with previous tradition, the “permanent floor” system (also known as interest-on-reserves regime) allows central banks to control interest rates separate from engaging in open market operations. Interest rates are now (largely) determined by the interest-on-reserves (IOR) rate, while excess reserves give the central bank freedom to let the monetary base fluctuate more widely.

Returning to Mundell’s paper, he begins by analyzing monetary policy under flexible exchange rates:

“Consider the effect of an open market purchase of domestic securities in the context of a flexible exchange rate system. This results in an increase in bank reserves, a multiple expansion of money and credit, and downward pressure on the rate of interest. But the interest rate is prevented from falling by an outflow of capital, which causes a deficit in the balance of payments, and a depreciation of the exchange rate. In turn, the exchange rate depreciation (normally) improves the balance of trade and stimulates, by the multiplier process, income and employment. A new equilibrium is established when income has risen sufficiently to induce the domestic community to hold the increased stock of money created by the banking system. Since interest rates are unaltered this means that income must rise in proportion to the increase in the money supply, the factor of proportionality being the given ratio of income and money (income velocity). (p.477)”

The earlier review of changes to the monetary regime makes it clear that this causal chain is fraught with errors. Starting from the beginning, “an increase in bank reserves” does not cause “a multiple expansion of money and credit” (see here) nor will it lead to “downward pressure on the rate of interest.” If interest rates are unchanged, there should be no outflow of capital and no subsequent depreciation of the exchange rate. The balance of trade therefore remains the same and the “multiplier process” never takes place. In complete contrast to Mundell’s conclusion, monetary policy (effectively QE) has no effect on income or employment under flexible exchange rates.*

Switching to monetary policy under fixed exchange rates:

“A central bank purchase of securities creates excess reserves and puts downward pressure on the interest rate. But a fall in the interest rate is prevented by a capital outflow, and this worsens the balance of payments. To prevent the exchange rate from falling the central bank intervenes in the market, selling foreign exchange and buying domestic money. The process continues until the accumulated foreign exchange deficit is equal to the open market purchase and the money supply is restored to its original level. (p. 479)”

As previously stated, the creation of excess reserves no longer affects the interest rate. This prevents the rest of Mundell’s process from taking place, but nonetheless results in the conclusion that monetary policy is ineffective.

This fixed exchange rate simulation serves as the basis for the Impossible trinity. Given free capital flows and a fixed exchange rate, the central bank is forced to counteract open market operations with equivalent opposing actions in the foreign exchange market. Since the money supply is ultimately unchanged, the country is said to have relinquished its monetary policy independence. However, under the current monetary policy regime this outcome is drastically altered.

Mundell examines the common case of a country trying “to prevent the exchange rate from falling. (p. 479)” Using a “permanent floor” system the central bank can maintain its interest rate policy and a fixed exchange rate, but faces limitations since “the central bank intervenes in the market, selling foreign exchange and buying domestic money. (p. 479)” One limitation arises when the central bank runs out of salable foreign exchange. Another limitation occurs once the central bank drains all excess reserves from the system, forcing it to forgo either its interest rate or exchange rate policy. These limitations suggest the Impossible Trinity will hold in the long run.

Now consider the less frequent and more recent case of a country trying to prevent its exchange rate from rising. The central bank manipulates the market exchange rate by buying foreign exchange and selling domestic currency. Contrary to the previous example, the central banks actions suddenly appear unlimited. Since the central bank can always create new reserves, it faces no limitations in selling domestic currency. Meanwhile if the demand to trade foreign exchange for domestic currency dries up, then the central bank will have successfully defended its peg. Therefore, as long as the Fed is willing to accept the risks associated with a balance sheet full of foreign exchange, the Impossible trinity is no longer impossible.

The Impossible trinity stems from Mundell and Fleming’s attempt to incorporate an open economy into the IS-LM model. Their analysis reflects an understanding of the Bretton Woods system, which ruled monetary policy at that time. Today’s monetary system and policy operations are a far cry from the Bretton Woods system, yet the Mundell-Fleming model has not been updated accordingly. Beyond minimizing the effects of monetary policy, the transformation of monetary policy to a “permanent floor” system has made the previously impossible, possible.

*In reality, monetary policy (QE) will affect income and employment to some degree for reasons not outlined by Mundell. However, those effects are likely to be small and could be either positive or negative.

Related posts:

Does the Permanent Floor Affect the Inflationary Effects of the Platinum Coin?

The Permanent Floor and Potential Federal Reserve 'Insolvency'

Fed's Treasury Purchases Now About Asset Prices, Not Interest Rates

The Money Multiplier Fairy Tale

Currency Intervention and the Myth of the Fundamental Trilemma

IOR Killed the Money Multiplier

Despite Hicks' Denouncing His IS-LM Creation, The Classroom Gadget Lives On

Bibliography

Mundell, R. A. "Capital Mobility and Stabilization Policy under Fixed and Flexible Exchange Rates." The Canadian Journal of Economics and Political Science 29.4 (1963): 475-85. Print.

...is from Nobel Laureate Robert Laughlin’s book, A Different Universe: Reinventing Physics from the Bottom Down:

One of the greatest disservices we do to our students is to teach them that universal physical law is something that obviously ought to be true and thus may be legitimately learned by rote. This is terrible on many levels, the worst probably being the missed lesson that meaningful things have to be fought for and often require great suffering to achieve. The attitude of complacency is also opposite to the one that brought these beautiful new ideas into the world in the first place—indeed, what brings things of great importance into the world generally. The existence of physical law is, in fact, astonishing and should be just as troubling to a thinking person today as it was in the seventeenth century when the scientific case for it was first made. We believe in universal physical law not because it ought to be true but because highly accurate experiments have given us no choice. (pp. 28-29)

At Worthwhile Canadian Initiative, Livio Di Matteo asks Why Is Manufacturing Special? (emphasis added):

Is there a special economic value or role to manufacturing that makes it special? Coyne feels: “If it’s about anything, it’s about aesthetics, or a sort of sectoral snobbery, the kind that finds the prospect of being “hewers of wood and drawers of water” so unspeakably vulgar. And yet it is presented as if it were an economic argument.” My gut feeling is that this tendency to put manufacturing on a pedestal is rooted in an almost 1930s Soviet-style view of economic development with heavy industry and manufacturing being the high ground of the economy. Industrialization is seen as a sort of “higher-level” of economic activity after agriculture and resource extractio - a logical higher-order stage.

…

What is also interesting in all of this is why in a similar vein we do not view manufacturing as backward in relation to the post-industrial knowledge economy of high end financial, medical and knowledge services? Surely, if our society is imbued with a tendency to view economic development as a series of sequential progressive higher-level stages, why not also consign manufacturing - and specifically automobile production - to the dustbin of history? Is not the highest stage of economic development one in which we effortlessly glide from one shopping and dining experience to another while not having to produce anything that is physically tangible all the while powered by friendly and renewable green energy and green transport modes? I repeat the question raised by Coyne, why is manufacturing special?

Matteo raises more questions than he answers in this post, but all are extremely pertinent to public policy today and moving forward. Previous posts on this blog have highlighted the ongoing bailouts and subsidies provided by the U.S. government to auto manufacturers (see here and here). In contrast to my views and seemingly those of Matteo, the mainstream media frequently depicts declining employment within the manufacturing sector (seen below) as a major concern.

On this point Matteo’s question, in bold, reaches the heart of the matter. During and following the industrial revolution, the share of employment confined to the agricultural sector substantially declined.

Although numerous government subsidies for that sector remain in place today, only a small minority of the population actually prefers returning to a largely agricultural society.

Emerging economies around the world are still expanding their manufacturing capabilities and offering goods at prices much lower than those obtainable with domestic production. Though the road to change has been and will continue to be filled with numerous potholes, rewards from reaching a higher stage (not necessarily the highest) of economic development will surely be worth the costs. For several countries, including the US (see below), the next large shift in employment, away from manufacturing and towards a service-based economy, has already occurred.

The time has come for developed countries to accept this new reality and adjust public policy accordingly.

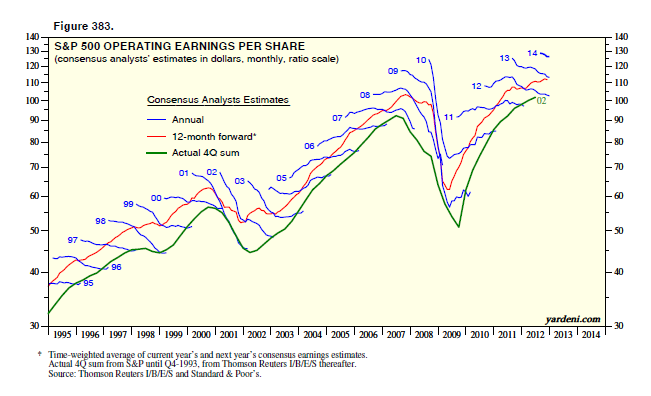

1) S&P 500 Earnings Squiggles by Ed Yardeni @ Dr. Ed’s Blog

The estimates for 2012 and 2013 mostly fell all last year, yet the S&P 500 rose 13.4%. I have the Squiggles data back to 1979 on a monthly basis. More often than not, they tend to trend down; yet more often than not, the market has trended higher. That’s because the market discounts 12-month forward consensus expected earnings. A good proxy for this concept is forward earnings, i.e., the time-weighted average of consensus estimates for the current and coming years. It tends to be a good 12-month leading indicator for actual profits, with one important exception: Analysts don’t see recessions coming until we all do too.

Woj’s Thoughts - After viewing this chart a few times, several observations stand out from the rest: 1) Each “earnings squiggle” that rises near the end is associated with higher actual earnings. 2) Each “earnings squiggle” that falls near the end forecasts at least a temporary decline in actual earnings. 3) Earnings estimates for 2010, at the beginning of 2009, were higher than forecasts for the current year (2013) and equivalent to current estimates for 2014. 4) The clear upward bias in estimates promotes higher prices, to the degree market participants trust the forecasts.

2) Why the US economic crisis is a depression and not a recession by Edward Harrison @ Credit Writedowns

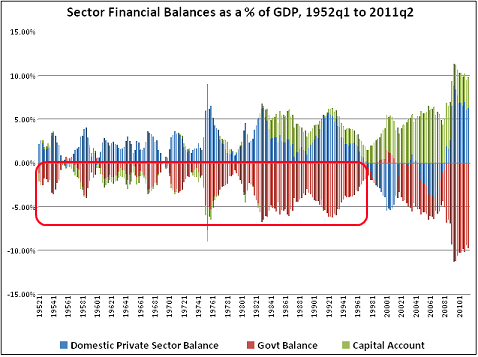

What is now playing out in Congress is very much in line with what I said a little over three years ago in October 2009. Deficit fatigue has become too large to resist. Austerity is coming to the US. The crux here is to remember that this has been a crisis brought on by high private debt – not public debt or deficits. The government has been effective in preventing a private sector debt deflation by providing economic stimulus, permitting large-scale deficit spending and bailing out the banks. This has added a huge slug of net financial assets to the private sector and supported asset prices and private sector balance sheets. When these government deficits get cut, there will be serious pain in the private sector because balance sheets are still stressed and the result will be a relapse into economic depression.

Woj’s Thoughts - The House Republicans have agreed to temporarily raise the debt ceiling and postpone the debate over sequestration in return for Congress (focusing on the Senate Democrats) actually passing a budget for the first time in four years. Backed into a corner, this is probably the best decision for the Republicans as it puts the onus (temporarily) on Democrats to reach a budget agreement. This progression raises the chances that spending cuts, either tied to sequestration or the budget, will take place this year. With the tax hikes already in place, the smaller deficits could very well lead to the outcome that Edward fears.

3) Ben Bernanke Is Facing A Legacy Problem by Bruce Krasting @ Money Game

Bernanke’s term at the Fed will set many historical precedents. To a significant extent, history will judge Bernanke on what he did while chairman of the Fed. But the books will also look at what happened after he left.

I believe that Bernanke would very much like to leave his successor with a Fed that had policy choices. As of today there are no options left. Just more useless QE. I doubt that Bernanke wants to exit with the Fed’s foot planted firmly on the gas pedal. The next guy does deserve a cleaner plate than now exists.

Is the Legacy factor influencing Bernanke? I think it has some sway in his thinking. Consider what Greenspan did before he left. After years of soft monetary policy he ratcheted up the Federal Funds rate 17 times in 22 months. He took the funds rate from 1% all the way up to 6%. Part of that rapid increase was driven to get monetary policy “neutral”, so that Bernanke could do as he wished. Not long after Bernanke took over, he took the funds rate down to zero.

Clearly, Greenspan tried to get monetary policy back to neutral before he left, I don’t see any reason why Bernanke would think differently. Are we watching a repeat of history? At a minimum, his legacy, and where he wants the Fed to be when he leaves, is part of Ben’s thinking today.

Woj’s Thoughts - It’s hard to argue with this logic given Greenspan’s actions as Fed Chairman prior to the last two years of his reign. While deserve is an overly strong word in this instance, my guess is the next Fed Chairman would appreciate having the option to ease, beyond merely expanding QE. With initial unemployment claims now at multi-year lows and a labor force still in decline, the table is set for a further meaningful drop in the unemployment rate. As the rate approaches 7 percent, I suspect Fed chatter about ending QE will pick up. If the legacy issue is simultaneously weighing on Bernanke’s mind, the urge to pull back on easing may be too great to ignore. Considering the ongoing multiple expansion in stock markets, it appears most market participants are not yet discounting this potential outcome.

1) Hit the “Defer” Button, Thanks… by David Merkel @ The Aleph Blog

This is why I believe that the biggest issue in restoring prosperity globally, is finding ways to have creditors and stressed debtors settle for less than par on debts owed. Move back to more of an equity culture from what has become a debt culture. A key aspect of that would be making interest paid non-tax-deductible for corporations, housing, etc., while making dividend payments similar to REITs, while not requiring payouts equal to 90% of taxable income. Maybe a floor of 50% would work, with the simplifying idea that companies get taxed on their GAAP income — no separate tax income base. Would certainly reduce the games that get played.

Anyway, those are my opinions. The world yearns for debt relief, but governments and central banks argue with that, and in the short-run try to paper over gaps with additional short-term debt that they think they can roll over forever. They just keep trying to hit the “defer” button, avoiding any significant reforms, in an effort to preserve the “status quo.”

Woj’s Thoughts - After reviewing the results of my 2012 predictions, I mentioned:

My main takeaway is that politicians are far more determined to maintain the status quo than I had expected. The underlying economic (and social) problems have once again been kicked down the road for future governments to handle.

Although David’s policy recommendations are becoming increasingly pervasive, they unfortunately remain nowhere near the level necessary for governments to test uncharted waters.

2) Can Germans become Greeks? by Dirk @ econoblog101

The ECB as well as other policy makers and politicians do not understand economics. They think that a simple recipe like “decrease government spending, export more” is enough to solve the euro zone crisis. The increase in government debt is a symptom of the crisis, not a cause. The cause of rising government debt was negative economic growth and bank bail-outs. These are the two problems which must be tackled. They are intertwined, so solutions should address both. Households cannot pay their mortgages in Spain and Ireland at the existing unemployment levels, and that is due to a lack of demand as households consume less and save more. This downward spiral must be stopped and turned around, since at negative growth rates even a government debt of €1 is too high.

It seems that instead of Greeks becoming Germans now the German are becoming Greeks. That means that without government spending Germany will not have positive growth rates. While this will come as a surprise to many, it shouldn’t be.

Woj’s Thoughts - Germany managed to run a slight fiscal surplus during 2012 that ultimately came at the expense of growth. In the fourth quarter, German GDP shrank by 0.5 percent. Meanwhile, attempts at structural reform (i.e. fiscal consolidation) in the European periphery appear to be speeding up the rise in unemployment and decline in growth. This dynamic is neither economically or socially sustainable, therefore the governments and ECB must either substantially change the current course or wait for countries to eventually exit the Eurozone.

3) Did We Have a Crisis Because Deficits Were Too Small? by JW Mason @ The Slack Wire

The logic is very clear and, to me at least, compelling: For a variety of reasons (including but not limited to reserve accumulation by developing-country central banks) there was an increase in demand for safe, liquid assets, the private supply of which is generally inelastic. The excess demand pushed up the price of the existing stock of safe assets (especially Treasuries), and increased pressure to develop substitutes. (This went beyond the usual pressure to develop new methods of producing any good with a rising price, since a number of financial actors have some minimum yield -- i.e. maximum price -- of safe assets as a condition of their continued existence.) Mortgage-backed securities were thought to be such substitutes. Once the technology of securitization was developed, you also had a rise in mortgage lending and the supply of MBSs continued growing under its own momentum; but in this story, the original impetus came unequivocally from the demand for substitutes for scarce government debt. It's very hard to avoid the conclusion that if the US government had only issued more debt in the decade before the crisis, the housing bubble and subsequent crash would have been much milder.

Woj’s Thoughts - The scenario laid out by JW sounds equally plausible and compelling to me. Changes in tax policies during the 1980’s and 1990’s set the stage for massive increases in real estate loans and the corresponding housing price boom. Then the unmet demand for safe-liquid assets prompted both the rise of shadow banking and the dispersion of U.S. housing assets to the rest of the world. So as the last sentence attempts to make clear, the “crash would have been much milder” but a similar crisis would likely have occurred.

According to Comstock Partners, The Market Rally Is Based On Four Dubious Assumptions:

These assumptions are as follows:

1) Since almost every central bank in the world is aggressively easing, the market cannot go down.

2) Although the U.S. is facing a fight in Washington over the debt limit, the sequester and the expiration of the annual federal appropriation, various political threats over the last two years have passed without substantial market damage, and the same will happen this time.

3) S&P 500 earnings will rise to $108 in 2013, resulting in a current P/E multiple of only 13.7.

4) The economic recovery will kick into full gear once the problems in Washington are solved or again "kicked down the road."

I won’t deny that the ongoing strength and length of the current bull market has caught me by surprise. Large government budget deficits were initially very supportive of corporate profits, however those effects are waning just as profit margins are peaking. Meanwhile, weak economies at home and abroad have severely limited corporate revenue growth. The following chart looks at the percentage change in the S&P 500 sales per share, earnings per share, and operating earnings per share since the recession began in December 2007:

Considering the meager growth in GDP, one might have expected that sales per share would be effectively flat over this period. What may be surprising, is that minimal revenue growth has not prevented an astonishing rise in earnings per share. Regarding earnings per share, it’s worth pointing out the noticeable difference in volatility between the two separate measures. While I am no expert in accounting, there are countless ways in which companies can “manage” their earnings across time. With an increasing prevalence and usage of such (generally legal) measures, I suspect the magnitude of changes in earnings per share will continue to grow in both directions.

Out of curiosity, I decided to add the S&P 500 index to the chart above:

Despite the widespread focus on earnings and their supposedly fundamental value to stock valuations, prices have more closely tracked the cumulative change in revenues since the recession began. If profit margins are truly mean reverting and earnings are increasingly manipulated, than it is possible sales now provide a better metric of corporate profitability over the course of a business cycle. That being said, it’s equally plausible (perhaps more so) that this data merely represents an anomaly.

Regardless of whether the above graphs prove useful for forecasting, trend growth of earnings has been slowing rapidly. With interest rates practically at the zero lower bound (ZLB) and central bank balance sheet expansion already set in place, potential drivers of further multiple expansion appear limited. In the near-term I expect that current momentum will drag markets higher, possibly to new all-time highs (for the Dow and S&P 500). However, looking further out on the horizon (3-5 years) I believe the present cyclical bull market is tiring and that the secular bear market will re-exert itself, leading to tests of the 2009 lows.

1) Nine facts about top journals in economics by David Card and Stefano DellaVigna @ VoxEU.org

Second, as Figure 2 shows, the total number of articles published in the top journals declined from about 400 per year in the late 1970s to around 300 per year in 2010-12. The combination of rising submissions and falling publications led to a sharp fall in the aggregate acceptance rate, from around 15% in 1980 to 6% today. Currently, QJE is the most selective of the top-five journals, with an acceptance rate of around 3%, followed by JPE and RES, with acceptance rates of around 5%. The least selective of the top-five are AER and Econometrica, with acceptance rates of around 8%.

Figure 2. Number of articles published per year

Notes: Publications exclude notes, comments, announcements, and Papers and Proceedings. Totals for 2012 estimated.

Over time, and especially during the last 15 years, it has become increasingly difficult to publish in the top five journals. Other things equal, this suggests that hiring and promotion benchmarks based on top-five publications (e.g., “at least one top-five publication for tenure”) are significantly harder to reach. (emphasis added)

Woj’s Thoughts - Although I can’t find a link at the moment, recent work in this field also shows the age of author’s publishing in the top journals rising over the past several years. As an aspiring academic in the field of economics, the combination of these results is slightly demoralizing. However, the recent introduction of a few new journals provides reason to hope the landscape may be changing. The path forward will be difficult in either case, but I have faith that hard work and persistence will ultimately lead to attainment of my professional goals.

2) The Coin is Dead! Long Live the Coin! by Michael Sankowski @ Monetary Realism Noah Smith asks a funny question on Twitter:

Noah Smith asks a funny question on Twitter:

”Hey, anyone remember the trillion dollar coin? ^_^ ”

I’d say Paul Krugman and Steve Waldman remember the trillion dollar coin quite well. So do all of the people listed by Steve Waldman in the beginning (and the end, Frances and Ashwin!) of his post.

The coin was only an idea, only supposed to spark a debate about the ability of the government to issue money directly. It was a big, shiny lure dangling in front of fish.

Then, the debt ceiling came along and changed the coin from “funny and interesting idea” to “necessary if we want to avoid an economic meltdown“. That debate catapulted the coin to fame, and fortunately kickstarted the debate Paul K, Steve W and others are having now.

Woj’s Thoughts - With an apparent temporary resolution to the debt ceiling, this debate has died down over the past several days. For those who might not normally read through the comments sections, I highly recommend making an exception for the discussions that took place on Scott Fullwiler’s post and all of Waldman’s. If that’s asking too much, at least check out my contributions to the debate (see here, here, and here) because as Mike notes, “ Joshua Wojnilower (Woj) gets it right away.”

3) Is Chinese re-balancing bullish? by Cam Hui @ Humble Student of the Markets

Rebalancing = Growth slowdown

So a move to re-balance growth to the household sector good news and bullish for stocks and risky assets? Well, not in the short term. Here is Pettis' arithmetic:

"But let us...give China five years to bring investment down to 40% of GDP from its current level of 50%. Chinese investment must grow at a much lower rate than GDP for this to happen. How much lower? The arithmetic is simple. It depends on what we assume GDP growth will be over the next five years, but investment has to grow by roughly 4.5 percentage points or more below the GDP growth rate for this condition to be met.

If Chinese GDP grows at 7%, in other words, Chinese investment must grow at 2.3%. If China grows at 5%, investment must grow at 0.4%. And if China grows at 3%, which is much closer to my ten-year view, investment growth must actually contract by 1.5%. Only in this way will investment drop by ten percentage points as a share of GDP in the next five years.

The conclusion should be obvious, but to many analysts, especially on the sell side, it probably needs nonetheless to be spelled out. Any meaningful rebalancing in China’s extraordinary rate of overinvestment is only consistent with a very sharp reduction in the growth rate of investment, and perhaps even a contraction in investment growth." (quotation marks added for clarity)

Woj’s Thoughts - Many analysts, not including Cam or Michael Pettis, continue to under appreciate the degree to which actual re-balancing in China will dampen growth prospects. This is precisely the difficult policy decision facing China’s leaders today. So far, China has responded to slower growth by increasing investment (fiscal stimulus) and thereby reversing re-balancing efforts. While this will likely boost GDP in the short-term (as seen in Q4 2012), correspond increases in “financial fragility” will only serve to exacerbate the downside in the longer-run.

Michael Sankowski, at Monetary Realism, asks us to consider the possibility that we are on a Real Estate Monetary Standard:

I’ve been thinking a lot about this over last few weeks when I have the chance to think. It seems like we are on a real estate monetary standard. Much like how we can use assets like gold to create a commodity money system, it seems like we operate our current monetary system as a real estate standard.

Banks create money against real estate assets. We use this money in our day-to-day transactions, without much thought about what stands behind this money, but most loans are for residential and commercial real estate.

If we did operate under a real estate standard, we would expect to see the larger economic business cycle greatly impacted by the real estate cycle, far more than the declines in real estate activity would predict.

The impetus for this discussion is a recent paper by Ed Leamer, “Housing is the Business Cycle,” that confirms Mike’s prediction. The following graph shows real estate loans at all commercial banks as a percentage of total loans and leases: Notice that the percentage held relatively steady around 25 percent for nearly 40 years following the end of WWII. Then, in the mid-1980’s, the percentage surged higher. This massive change may have been a consequence of the Tax Reform Act of 1986 that included “ increasing the Home Mortgage Interest Deduction,” a “Low-Income Housing Tax Credit,” and changes to “ the treatment of imputed rent, local property taxes, and mortgage interest payments to favor homeownership.” After leveling off in the mid-1990’s, the percentage of real estate loans once again spiked higher beginning in late 1998. Once again, changes in tax policy may have played a substantial role. The Taxpayer Relief Act of 1997 substantially lowered the capital gains rate and “exempted from taxation the profits on the sale of a personal residence of up to $500,000 for married couples filing jointly and $250,000 for singles.”

Notice that the percentage held relatively steady around 25 percent for nearly 40 years following the end of WWII. Then, in the mid-1980’s, the percentage surged higher. This massive change may have been a consequence of the Tax Reform Act of 1986 that included “ increasing the Home Mortgage Interest Deduction,” a “Low-Income Housing Tax Credit,” and changes to “ the treatment of imputed rent, local property taxes, and mortgage interest payments to favor homeownership.” After leveling off in the mid-1990’s, the percentage of real estate loans once again spiked higher beginning in late 1998. Once again, changes in tax policy may have played a substantial role. The Taxpayer Relief Act of 1997 substantially lowered the capital gains rate and “exempted from taxation the profits on the sale of a personal residence of up to $500,000 for married couples filing jointly and $250,000 for singles.”

The shifting of bank lending from primarily commercial to real estate loans has clearly been accompanied by shifts in policy to vastly reduce taxes accompanying rents, interest and capital gains. These changes, as well as other public policy initiatives, have helped significantly increase the value of homes that could be borrowed against. As Michael Hudson argues in The Bubble and Beyond, the overall effect has been to transfer former tax payments to private financial institutions, ultimately increasing wealth inequality and making the economy (and government) more beholden to the banks.

Although total real estate loans have actually fallen during the past few years, they still account for nearly 50 percent of total loans. This real estate monetary standard is certainly not restricted to the U.S. and actually appears to be prominent in Europe, as well as several other developed nations. To the degree that bank lending affects aggregate demand, real estate will clearly continue to have an outsized effect on the global business cycle.

(Note: For those interested, Leamer actually discussed this paper during an episode of EconTalk with Russ Roberts back in May 2009.)

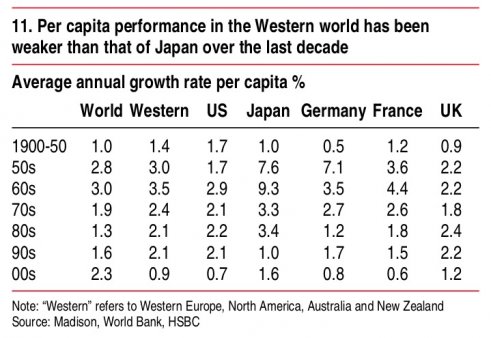

Lord Keynes, at Social Democracy for the 21st Century, provides data on Japanese Real GDP Growth from 1925–2001 and notes the following:

In the 1980s, Japan engaged in ill-conceived financial deregulation (Fukao 2003: 134–135), which was one major cause of the asset bubble in these years (although poorly designed tax policies and monetary policy were clearly involved too). The collapse of the asset bubble and the balance sheet recession (a form of debt deflationary crisis) caused the “lost decade.”

From the data above, we can see that the “lost decade” was really an era of low growth, not continuous negative growth. Japan was not in recession from 1993–1997, but had serious deleveraging problems, a banking crisis, and debt deflation.

Many myths have arisen about the lost decade, and one of them is that Keynesianism somehow “failed” to work in this era. That is nonsense. If anything, Keynesianism saved Japan from a terrible depression. In fact, when fiscal stimulus was abandoned for austerity in 1997, the economy plunged into a recession in 1998.

Of the myths regarding Japan’s lost decade (now decades), I’ll admit to having been unaware that 1998 marked the first year of negative real GDP growth since 1974 (and only second since 1945!). Since then, Japan has unsuccessfully tried to get on a fiscally sustainable path (whatever that means) as more frequent recessions have led to larger budget deficits (and growing debt/GDP) that merely prevent larger economic declines. Despite the persistence of misguided fiscal (and monetary) policy, Japan’s per capita economic growth has remained on par with the Western world.

With nonfinancial private sector balance sheets largely repaired, Japan appears poised to continue leading the Western world if government policies improve. Unfortunately last night’s Joint Statement of the Government and the Bank of Japan on Overcoming Deflation and Achieving Sustainable Economic Growth shows the lessons of a previous age remain forgotten.

...is from Michael Hudson’s fantastic book, The Bubble and Beyond:

Central bank policies that raise interest rates to slow new direct investment and hiring make economies even less able to carry their debt burden. In this respect the buildup of savings and encouragement of debt financing encourages a buildup of financial returns rather than tangible capital investment. Thus is antithetical to the goal of promoting high wages and rising labor productivity. The rate of interest is permitted to govern the doubling times of savings without the moral, political and religious checks that have rolled back the growth of financial overhead throughout history. There is only one ultimate solution: Debts that cannot be paid, won't be. The open question is, will this tear economies apart as the financial sector fights against fate?

There are clear signs from around the globe that this process is, in fact, tearing economies apart. Despite mass unemployment and declining living standards, many countries continue to support their private financial institutions in the misguided hope that further lending will make households and nonfinancial corporations better able to carry their debt burdens. Until this process is dismantled or reversed, the prospects for sustained economic growth in these countries remains heavily subdued.