Earlier this week I discussed the dangers of misunderstanding “helicopter money” and higher inflation targets. A focus of that post was the incentives stemming from negative real interest rates that will lead to greater investment in real assets, not businesses. The obvious implication is that negative real interest rates entail significant risk of spurring asset bubbles.

This discussion of asset bubbles comes on the heels of St. Louis Federal Reserve Governor Jeremy Stein’s speech that suggested the Fed was becoming increasingly concerned about bubbles, not inflation. According to a recent Bloomberg article, apparently Fed Chairman Bernanke was not onboard with the supposed shift (h/t Tim Duy):

Federal Reserve Chairman Ben S. Bernanke minimized concerns that the central bank’s easy monetary policy has spawned economically-risky asset bubbles in comments at a meeting with dealers and investors this month, according to three people with knowledge of the discussions.

Do Bernanke’s comments imply the change Stein alluded to is not really happening? Not necessarily. To understand why, one must consider the goals assigned to Bernanke or any Fed Chairman for that matter. The following is from Chapter 2 of the Federal Reserve System’s own publication, Purposes & Functions:

The goals of monetary policy are spelled out in the Federal Reserve Act, which specifies that the Board of Governors and the Federal Open Market Committee should seek “to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.”

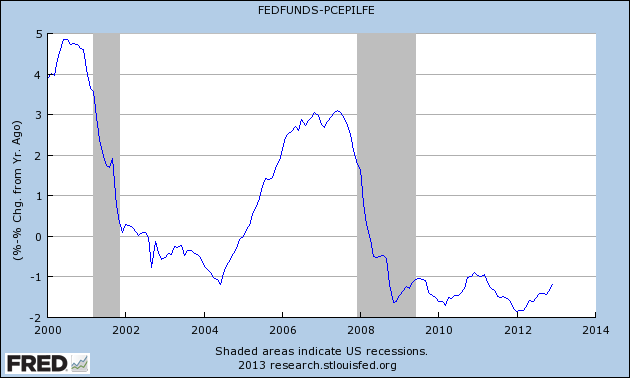

Although no explicit mention of preventing asset bubbles is made, the goal of stable prices leaves the door open for such an interpretation. Before addressing the Fed’s own interpretation of stable prices, its worth discussing the specific types of assets that are seemingly most prone to bubbles. The three major categories are commodities (e.g. oil, copper, sugar), financial assets (e.g. stocks and bonds), and housing. During the past decade real interest rates have actually been negative more often than not (Real Interest Rate = Effective Fed Funds rate - core PCE):

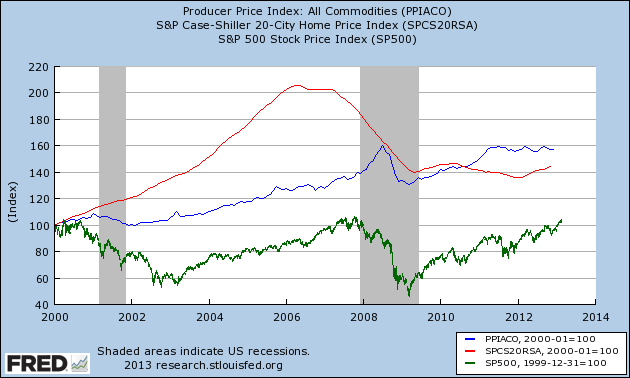

Unsurprisingly the past decade has also witnessed asset bubbles in commodities, stocks and housing:

Prices of these assets have clearly been anything but stable. So has the Fed failed in that aspect of its mandate? The answer is a resounding “NO.”

To remedy the cognitive dissonance readers may be experiencing, consider how the aforementioned real assets affect the FOMC’s preferred inflation measure, core Personal Consumption Expenditures (PCE). Financial assets are noteworthy in their distinct omission from the type of products making up PCE. Commodities are included in the general price measure, however core PCE is calculated by excluding a couple of the more volatile commodity components: food and energy. Housing is actually included in core PCE but is calculated using the space rent of nonfarm owner-occupied homes, not actual house prices. Focusing on core PCE thereby removes any direct concern with asset bubbles.

Bernanke has already announced his plans to step down as Fed Chairman early next year (2014). Given the Fed’s stated mandate and preferred measure of prices, it is no wonder that Bernanke is unconcerned with asset bubbles. The goals of his chair are to maximize employment and maintain stable prices. Since the types of assets prone to bubbling are not included in core PCE and appear relatively uncorrelated with that measure, to the degree that bubbles can benefit employment in the short run, they may actually be desirable.*

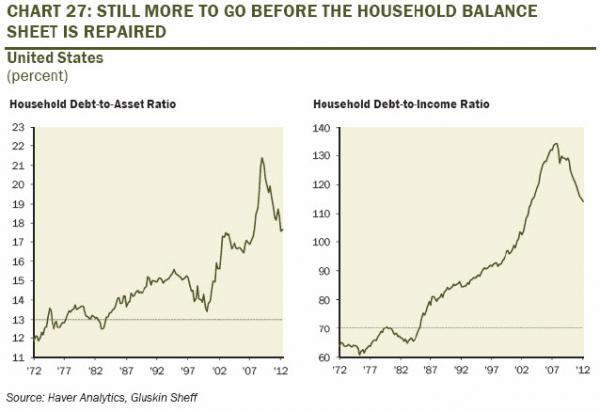

These institutional incentives of a Fed Chairman are unfortunately at odds with the country’s longer term economic goals. Asset bubbles created by excessive lending and/or negative real interest rates are always followed by busts. These busts are simply the recognition of malinvestment that already took place during the boom. If the booms are financed with significant leverage, the resulting deleveraging may lead to a debt deflationary spiral. Whether or not that’s the case, though it usually is, malinvestment suppresses both employment and economic growth over time.

One can argue over whether Bernanke’s views on the effectiveness of monetary policy are correct or not, but his decision to ignore asset bubbles is perfectly rational given the circumstances. Shifting the Fed’s focus from inflation to bubbles will therefore require changing the institutional incentives.

*The three major asset categories mentioned above presumably will have very different effects on employment. Among the three, commodity bubbles are least desirable from an employment perspective. Higher commodity prices generally hurt consumer spending, which may lead to a temporary decline in employment. Housing bubbles are the most desirable in these terms since the increased demand can generate a temporary employment boom in construction and housing-related services.

One of the best resources for investment advice and economic projections over the past several years has been David Rosenberg. Courtesy of Zero Hedge, here is part of his outlook for 2013:

The Fed has also completely altered the relationship between stocks and bonds by nurturing an environment of ever deeper negative real interest rates. Therein lies the rub. The economy and earnings are weak, and getting weaker, but the Interest rate used to discount the future earnings stream keeps getting more and more negative, and that lowers the corporate cost of capital and in turn raises the present value of expected future profits. It's that simple.

...

Beneath the veneer, there are opportunities. I accept the view that central bankers are your best friend if you are uber-bullish on risk assets, especially since the Fed has basically come right out and said that it is targeting stock prices. This limits the downside, to be sure, but as we have seen for the past five weeks, the earnings landscape will cap the upside. I also think that we have to take into consideration why the central banks are behaving the way they are, and that is the inherent 'fat tail' risks associated with deleveraging cycles that typically follow a global financial collapse. The next phase, despite all efforts to kick the can down the road, is deleveraging among sovereign governments, primarily in half the world's GDP called Europe and the U.S. Understanding political risk in this environment is critical.

...

With regard to global events, we continue to monitor the European situation closely. Euro zone finance ministers have given Greece an additional two-year lifeline and the Greek parliament just passed another round of severe austerity measures, which I think will only serve to make matters worse there from an economic standpoint, but I doubt that the creditors are going to let Greece go just yet. So this never-ending saga remains a source of ongoing uncertainty, but at the same time. Is a key reason why the Fed and the Bank of Canada will continue to keep short-term interest rates near the floor, and all that means is to build even more conviction over income equity and corporate bond themes.

...

As for something new, after a rather significant slowdown in China for much of this year that put the commodity complex in the penalty box for a period of time, we are seeing some early signs of visible improvement in the recent economic data out of China and this actually has happened even in advance of any significant monetary and fiscal stimulus. And while the Chinese stock market has been a laggard, if there is one country that does have the room to stimulate, it is China (make no mistake, however, China's economic backdrop is still quite tenuous, especially as it pertains to the corporate sector - excessive inventories, stagnant profits, rising costs and lingering excess capacity are all challenges to overcome).

Keep in mind that much of this slowing in China was a lagged response to prior policy tightening measures to curb heightened inflationary pressures - pressures that have since subsided sharply with the consumer inflation rate down to 2% (near a three-year low) from the 6.5% peak in the summer of 2011 and producer prices are deflating outright. What is providing a big assist to this sudden reversal of fortune in China is a re-acceleration in bank lending as a resumption of credit growth and bond issuance has allowed previously- announced infrastructure projects out of Beijing (railways in particular) to get incubated.

The nascent economic turnaround we are seeing in China, if sustained, is Positive news for the commodity complex and in turn resource-sensitive currencies like the Canadian dollar, which I'm happy to report has hung in extremely well this year even in the face of all the global economic and financial crosscurrents. Just consider that the low for the year for the loonie was 96 cents - you have to go back to 1976 to see the last time intra-year lows happened at such a high level.

...

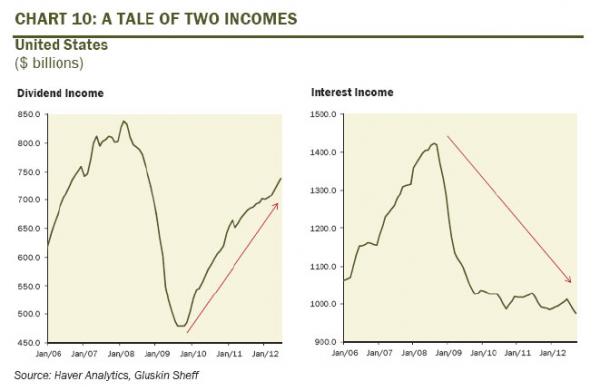

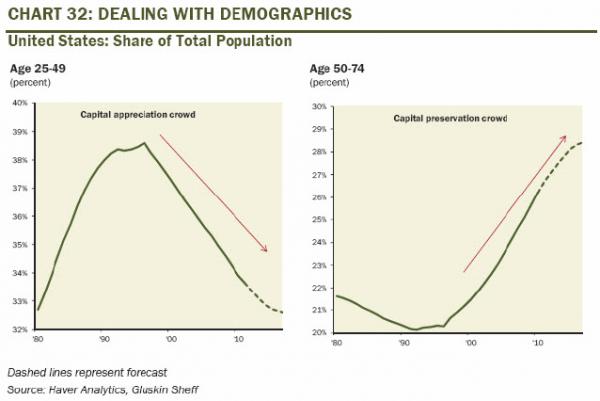

To reiterate, our primary strategy theme has been and remains S.I.R.P. - Safety and Income at a Reasonable Price - because yield works in a deleveraging deflationary cycle.Not only is there substantial excess capacity in the global economy, primarily in the U.S. where the "output gap" is close to 6%, but the more crucial story is the length of time it will take to absorb the excess capacity. It could easily take five years or longer, depending of course on how far down potential GDP growth goes in the intermediate term given reduced labour mobility, lack of capital deepening and higher future tax rates. This is important because what it means is that disinflationary, even deflationary, pressures will be dominant over the next several years. Moreover, with the median age of the boomer population turning 56 this year, there is very strong demographic demand for income. Within the equity market, this implies a focus on squeezing as much income out of the portfolio as possible so a reliance on reliable dividend yield and dividend growth makes perfect sense.

...

Gold is also a hedge against financial instability and when the world is awash with over $200 trillion of household, corporate and government liabilities, deflation works against debt servicing capabilities and calls into question the integrity of the global financial system. This is why gold has so much allure today. It is a reflection of investor concern over the monetary stability, and Ben Bernanke and other central bankers only have to step on the printing presses whereas gold miners have to drill over two miles into the ground (gold production is lower today than it was a decade ago - hardly the same can be said for fiat currency). Moreover, gold makes up a mere 0.05% share of global household net worth, and therefore, small incremental allocations into bullion or gold-type investments can exert a dramatic impact. Gold cannot be printed by central banks and is a monetary metal that is no government's liability. It is malleable and its supply curve is inelastic over the intermediate term. And central banks, who were selling during the higher interest rate times of the 1980s and 1990s, are now reallocating their FX reserves towards gold, especially in Asia. With the gold mining stocks trading at near record-low valuations relative to the underlying commodity and the group is so out of favour right now, that anyone with a hint of a contrarian instinct may want to consider building some exposure - as we have begun to do.

The Fed’s recent actions imply that it will permit inflation to temporarily rise above 2% in the hopes of reducing unemployment and spurring growth at a faster pace. While that occurrence remains to be seen, there is potential for even deeper negative real yields over the coming year to boost stocks further. However, as I’ve been arguing for many months, future earnings growth will likely be much weaker than expected and may turn negative. Last year I offered my own predictions for 2012. In the next couple weeks, I hope to discuss those successes and failures, while also putting forth new predictions for 2013. In the meantime, here are few charts from Rosenberg’s outlook that caught my eye:

1) Pettis: The Chinese rebound will be short by Houses and Holes

If we assume that China will have no problem sailing through its economic rebalancing, the European crisis, and everything else, then clearly we don’t need to worry about anything. But if China’s rebalancing is accompanied by a sharp slowdown in economic growth, or if it occurs during a worsening of the European crisis – both very likely scenarios – then we need to think about what the debt burden will be under those conditions.

So, for example, will commodity prices drop? I think they will, perhaps by as much as 50% over the next three years, and to the extent that there is still a lot of outstanding debt in China collateralized by copper and other metals (and there is), our debt count should include estimates for uncollateralized debt in the event of a sharp fall in metal prices. Will slower growth increase bankruptcies, or put further pressure on the loan guarantee companies? They almost certainly will, so we will need again to increase our estimates for non-performing loans.

Will capital outflows increase if growth slows sharply? Probably, and of course this puts additional pressure on liquidity and the banking system, and with refinancing becoming harder, otherwise-solvent borrowers will become insolvent. Will rebalancing require higher real interest rates, a currency revaluation, or higher wages? Since rebalancing cannot occur without an increase in the household income share of GDP, and since these are the biggest implicit “taxes” on household income, there must be a net increase in the combination of these three variables, in which case the impact on net indebtedness can be quite significant depending on which of these variables move most. Since I think rising real interest rates are a key component of rebalancing, clearly I would want to estimate the debt impact of a rise in real rates.

2) Guest Contribution: ‘The Making of America’s Imbalances’ by Paul Wachtel and Moritz Schularick

Last but not least, in the paper we point to a potentially important distinction that was lost in previous analyses of household savings behavior. When we delve deeper into the role of capital gains for savings and borrowing decisions, we uncover a close statistical relationship between gains in equity (but not housing) wealth and active savings decisions (i.e., acquisition of financial assets) by American households. Borrowing behavior, by contrast, depends much more closely on fluctuations in housing wealth, both directly because of higher values of the housing stock and indirectly through mortgage equity withdrawals. We think that this result challenges the (conventional) wisdom that non-leveraged equity market bubbles pose a lesser problem for macroeconomic balance than credit-fueled housing bubbles. Our results indicate that equity market bubbles too trigger substantial changes in the financial behavior of households. The economic and financial repercussions of those could be costly to reverse at a later stage.

3) Is the Fed Eyeing a New Kind of Twist? by David Schawel

An astute Credit Suisse analyst pointed out this week that the Fed could perform a “MBS Twist” operation in which they sell up in coupon premium MBS pools and buy lower coupon MBS which could have the affect of lowering mortgage rates to borrowers. In their own words:

“…this policy will specifically target the near par secondary MBS rate, the key driver of the primary rate that is offered to the consumer. Consumers spend “permanent income”, not temporary tax rebates…Operation MBS twist will reduce mortgage payments and redirect consumer cash to increase M-velocity and bump up inflation.”

To put this in perspective, the Fed owns ~$530bil of Fannie 4.5-5.5% pools (purchased during QE1) in which they have an unrealized gain of ~$32bil. 30yr 3.5’s (borrower rates of 4%) still comprise the lions share of origination volume, but 30yr 3.0’s are in production now as well. Pushing down on 3’s and 3.5’s by buying almost all new production could, as CS points out, help compress the primary-secondary spread.

Woj’s Thoughts - Very interesting policy idea here. In essence this is a reverse Operation Twist, although the maturities are equivalent. My three initial concerns are the following: Will the increase in interest income from higher coupon pools exceed the reduction in net interest margin from new pools (i.e. will it help or hurt bank capital)? Do the higher coupon pools represent borrowers unable to refinance (due to credit worthiness or underwater mortgages), suggesting credit risk is shifting back to the private sector? Will markets perceive the policy as a “risk-off” since it reduces the incentive to shift outwards on the risk/yield curve?

Here’s a fun chart from Bloomberg comparing the price of oil (WTI-Crude) to the S&P 500 since the beginning of 2009...

Both markets were moving together until the past six weeks when oil began its sharp sell off. Considering the US remains heavily dependant on oil as a source of energy, among other things, it is often considered a sign of aggregate demand and thereby economic growth. Some analysts are trying to explain the divergence as a short-term oversupply issue in the oil markets, yet futures contracts across the board have been dropping rapidly. Similar price declines experienced by broad commodity indexes offers further support to global growth concerns.

US equity markets are increasingly becoming the odd-man out in global asset markets. The recent resilience can either be seen as a sign of strength or as a sign of complacency. If the latter option proves correct, markets may be setting up for a massive sell-off.

Related posts:

Extension of Operation Twist Suggests No QE Until After Election

One More Rally Before the Crash

IT IS VERY IMPORTANT TO DIFFERENTIATE within the commodities and resources sector because there is definitely a very hard landing and liquidation cycle under way in China. Longs of industrial metals in general should be avoided; however, some commodities, such as oil and grains, are less influenced by China. In commodities like uranium and solar, China is just getting started. Then there is a question as to whether a Chinese panic and capital flight will benefit precious metals [China and Silver].

Read it at Zero Hedge

The Central Banks Will Save You! – and other Hooks to Avoid

By Russ Winter

While I still don’t believe China will reach hard landing territory this year, GDP may very well end up below 7% for 2012 and is heading lower. The commodity and energy sector have taken a beating over the past six weeks, which presents some opportunities for investors. As the chart shows, China only consumes just over 10% of the world’s oil. Further economic deterioration in the US and Europe will push oil prices lower, but it’s hard to envision prices falling back near the lows of ‘09 without another serious global recession.

At this point, the US majors (CVX, XOM and COP) still look a little pricey, especially compared with their European counterparts (BP, E, TOT). These European oil plays offer dividend yields over 5%, 6% and 7%, respectively. Read the rest of Winter’s piece as well for his potentially actionable ideas.

Disclosure: I’m long BP, E and TOT. This is not a recommendation to buy/sell any of the stocks listed above. You should do your own homework and/or consult with an investment advisor before making any investment decisions based on these comments.

Related posts:

Predictions for 2012

Hugh Hendry - China Will Be Last Shoe to Drop

From a portfolio construction standpoint, the deflation/falling-price theme continues to suggest that protection of capital is a key strategy for a variety of asset classes.

Read it at Advisor Perspectives

The Deflation Trend

By Chris Kimble

Yesterday on Twitter I asked, ‘How soon until talk of deflation begins again?” Well, I didn’t have to wait very long. The above post showed up in my Google Reader list later in the afternoon. As the charts depict, Treasury yields are approaching new lows while commodities continue to slump (e.g. copper, gold, oil). While I don’t believe we will see outright deflation anytime soon, the disinflation trend may be with us for some time.