The beginning of a new year is apparently as good a time as any to start thinking about buying a new home. At the start of 2012 I found myself frequently engaged in discussions about whether or not it was finally the “right” time to buy a house. Mortgages with 30-year fixed rates were being offered around 4% and prices appeared to be stabilizing. Despite the widespread optimism, my conclusion was:

When deciding whether or not to purchase a home, there are certainly a whole host of factors to consider that were not discussed here (family, job security, income, savings/debt, location, etc). The purpose is to provide an alternative perspective to the seemingly common perception that now is the best time to buy and those who fail to act will miss a great opportunity. While I don’t rule out that possibility, I believe the outlook for home prices and mortgage rates suggests this window of opportunity will remain open for a few years. In fact, those who wait may be rewarded with lower mortgage rates and more house for their money. There is no rush to buy a home!

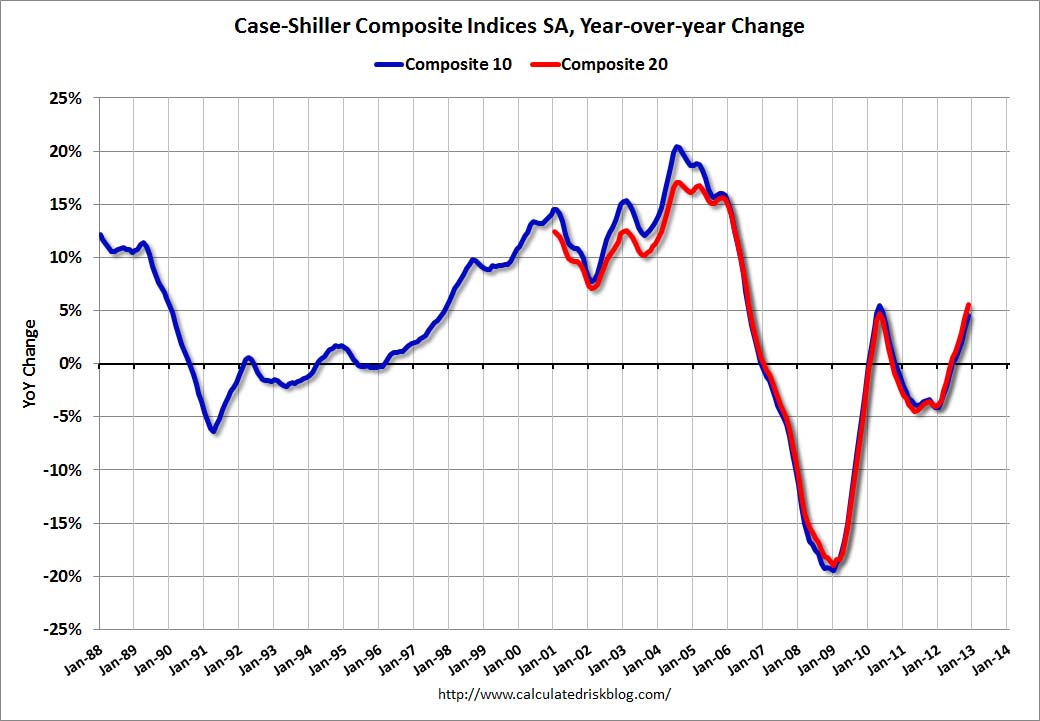

Now with the benefit of hindsight, my judgment appears to have held up relatively well. Although house prices have risen approximately 6 percent in the past year:

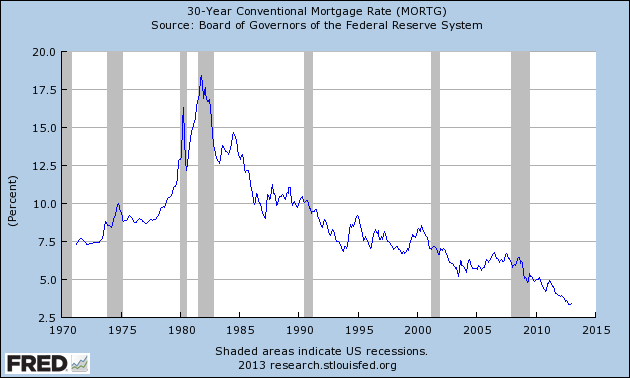

30-year fixed rate mortgages touched a new low of 3.3%: With 2013 only a month old, conversation among friends and family about buying new homes has picked up once again. Oddly enough, the substantial rise in prices over the past year is stoking demand for housing. (I say oddly because basic economics suggests demand should decrease when prices rise) However, before offering my views on future house prices, let me say a few words about mortgage rates.

With 2013 only a month old, conversation among friends and family about buying new homes has picked up once again. Oddly enough, the substantial rise in prices over the past year is stoking demand for housing. (I say oddly because basic economics suggests demand should decrease when prices rise) However, before offering my views on future house prices, let me say a few words about mortgage rates.

Over the past few months the FOMC has initiated QE3 (QEternity) and QE4, which involves purchasing $40 billion of Agency-MBS and $45 billion of Treasuries per month. Despite jubilant asset markets, inflation (core-PCE) and GDP growth remain well below 2 percent. This failure to stimulate real growth will likely lead the FOMC to extend its pledge of maintaining interest rates near 0 until at least 2016. Based on this combination of QE, ZIRP, low inflation, and stagnating growth, the chances of mortgage rates rising back above 4 percent anytime soon seems very limited.

Returning to the future direction of house prices, I remain skeptical that household balance sheets have been sufficiently repaired to permit a new debt-led boom. One of the better resources for housing market insights, Dr. Housing Bubble has highlighted the recent surge in investment demand. Meanwhile, Diana Olick discusses reports that Americans are tapping their homes for cash again. Clearly aspects of the previous bubble are returning, which makes it tough to rule out further gains in the short-term. That being said, US residential real estate just isn’t a great investment in real terms and here is Robert Shiller explaining why:

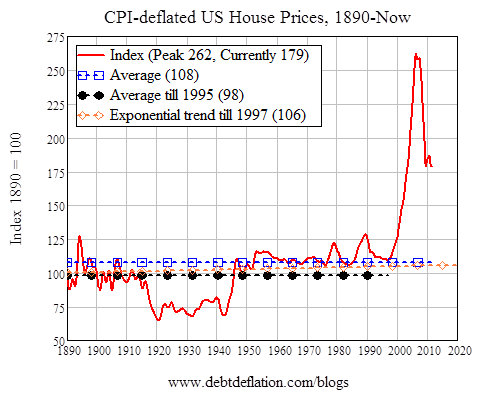

“Housing is traditionally is not viewed as a great investment. It takes maintenance, it depreciates, it goes out of style. All of those are problems. And there’s technical progress in housing. So, the new ones are better….So, why was it considered an investment? That was a fad. That was an idea that took hold in the early 2000′s. And I don’t expect it to come back. Not with the same force. So people might just decide, ‘yeah, I’ll diversify my portfolio. I’ll live in a rental.’ That is a very sensible thing for many people to do.

…From 1890 to 1990 the appreciation in US housing was just about zero. That amazes people, but it shouldn’t be so amazing because the cost of construction and labor has been going down.

…They’re not really an investment vehicle unless you want it for your personal reasons.”

If you want more proof, here is the chart Shiller is referencing:

My recommendation therefore remains basically the same as last year. Housing prices and mortgage rates may have bottomed, but the odds of either rising substantially in the next couple years remains small. Ultimately you should buy a house that you want to live in, not that you hope will be a good investment. If you plan on buying, just remember, there is no rush to buy a home!

1) China after the Global Minotaur by Yanis Varoufakis

In the book’s penultimate chapter, I discussed the Soaring Dragon which, as everyone tells us, is waiting in the wings, purportedly to take over from the Global Minotaur (click here for a pdf copy of that chapter). In my concluding remarks, written back in January 2011, I wrote: “To buy time, the Chinese government is stimulating its growing economy and keeps it shielded from currency revaluations, in the hope that vibrant growth can continue. But they see the omens. And they are not good. On the one hand, China’s consumption-to-GDP ratio is falling; a sure sign that the domestic market cannot generate enough demand for China’s gigantic factories. On the other hand, their fiscal injections are causing real estate bubbles. If these are unchecked, they may burst and thus cause a catastrophic domestic unwinding. But how do you deflate a bubble without choking off growth? That was the multi-trillion dollar question that Alan Greenspan failed to answer. It is not clear that the Chinese authorities can.”

In the eighteen months that followed since those lines were written, events have confirmed the projected pattern. The table below reveals that the falling rate of Chinese consumption is continuing unabated. In 2011 of every one dollar of income produced, only 29 cents entered China’s markets. With net exports making a small annual contribution to domestic demand (even though they contribute greatly to the country’s capacity to invest and, thus, boost productivity), the onus falls increasingly on investment to meet the demand shortfall. However, as suggested in the avove paragraph, this emphasis on investment is a double edged sword, as it threatens to let the Giny out of the bottle in real estate markets, where bubbles have been looming threateningly for a while now.

| | 1990 | 1995 | 2000 | 2005 | 2009 | 2011 |

| Private Consumption | 49 | 44 | 45 | 40 | 34 | 29 |

| Investment | 35 | 42 | 36 | 42 | 48 | 58 |

| Government Consumption | 12 | 13 | 17 | 12 | 11 | 10 |

| Net Exports | 4 | 1 | 2 | 6 | 7 | 3 |

Composition of Chinese Aggregate Demand (Percentages of Gross Domestic Product). Source: National Bureau of Statistics of China

Woj’s Thoughts - Most economists agree that China needs to re-balance its economy away from investment and towards private consumption. China has made very little progress, if any, in this regard. As for the potential housing bubble, opinions are far more divergent. After a recent trip to China, my wonderful professor, Garrett Jones, remarked that families were using second homes as a savings vehicle but faced difficulty in abruptly moving their larger, extended families living under the same roof. While I respect that view, the growth of private debt to purchase homes leads me to side with Yanis.

2) When the Credit Transmission Mechanism Breaks… by Cullen Roche @ Pragmatic Capitalism

If you look at the 30 year mortgage rate closely you’ll notice a relatively steady inverse correlation between rates and new home sales. That is, all the way up until about 2007. Then, rates remain low and new home sales stay depressed. The low rate transmission mechanism breaks.

Why does it matter? This is exactly what we’d expect to see given the state of the balance sheet recession. You see, demand for credit is very low because households are still recovering from the implosion in their balance sheets. Instead of taking on more debt, households are paring back debt. This is clear from yesterday’s NY Fed report on household credit trends. And this is why monetary policy has been so broken in recent years. The Fed can’t gain traction because their primary transmission mechanism is busted. And the economy won’t feel quite right until this part of the monetary system starts working normally again….

3) Death of a Prediction Market by Rajiv Sethi

A couple of days ago Intrade announced that it was closing its doors to US residents in response to "legal and regulatory pressures." American traders are required to close out their positions by December 23rd, and withdraw all remaining funds by the 31st. Liquidity has dried up and spreads have widened considerably since the announcement. There have even been sharp price movements in some markets with no significant news, reflecting a skewed geographic distribution of beliefs regarding the likelihood of certain events.

…

It seems to me that the energies of regulators would be better directed elsewhere, at real and significant threats to financial stability, instead of being targeted at a small scale exchange which has become culturally significant and serves an educational purpose. The CFTC action just reinforces the perception that financial sector enforcement in the United States is a random, arbitrary process and that regulators keep on missing the wood for the trees.

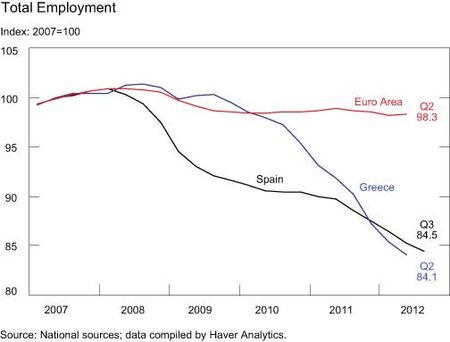

4) The Different Paths of Greece and Spain to High Unemployment by Thomas Klitgaard and Ayşegül Şahin @ Liberty Street Economics

The high unemployment rate in Greece is not surprising given the depths of its recession, but what explains Spain’s 25.8 percent unemployment rate given its much more modest downturn? One contributing factor is the fact that the composition of Spanish jobs made the economy vulnerable to dramatic job losses during a recession. In 2007, almost 13 percent of jobs in Spain were in construction, compared with roughly 8 percent in Greece and the euro area. Such a heavy weight on this sector made employment more vulnerable to a downturn given the fact that construction is the sector that typically experiences the steepest decline in a recession. Indeed, construction, as measured in the GDP accounts, fell 35 percent from 2007 to 2011, and the sector accounted for almost 60 percent of the decline in total employment over this period.

Another contributing factor is the very high percentage of employees tied to temporary work contracts in Spain. Data from the Organisation for Economic Co-operation and Development show that 32 percent of employees in Spain worked under temporary contracts and 68 percent under permanent contracts in 2007. In Greece, 10 percent were on temporary contracts; the figure for Europe as a whole was 15 percent.

Woj’s Thoughts - Both countries suffer from excessive private debt that is being transferred to the public sector as the private sector attempts to deleverage. Considering the size of the housing bubble in Spain (the bust continues), the relatively large portion of jobs in construction before the crisis and decline in employment within that sector afterwards are no surprise. However, the percentage of temporary workers in Spain is striking (Does anyone know if this is tied to cultural or policy reasons?). As both countries attempt to move towards balance budgets, the downward trend in unemployment and GDP is likely to continue.

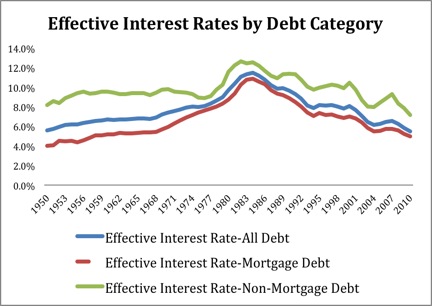

Arjun Jayadev recently presented the following chart showing the effective interest rate for households and private non-financial corporations:

Jayadev was trying to dispel the notion that

the key cause of the financial turmoil in the U.S over the last two decades was the excessively low interest rates.

Attempting to reconcile this new data with my own views on recent economic history, I came to the conclusion that low incomes were a more likely cause of the financial troubles.

After providing my own analysis, a couple questions remain:

1) The data was calculated using interest payments from the household sector. Yet some interest payments are tax deductible, notably mortgage interest payments. Changes in tax policy that increase deductions or credits related to interest payments, thereby reducing the effective interest rate, may therefore not show up in this data. Is there a way to account for tax policy changes in regard to effective interest rates? How would this alter the above chart?

2) The effective interest rate as shown above does not appear to account for changes in credit quality. Given comparatively weak income growth and high debt-to-income ratios, I would argue that general credit quality was deteriorating over the past two decades. If that’s true, why weren’t effective interest rates higher in the past 20 years than during the 1950-1970 period?

My instinct is that accounting for tax policy changes and credit quality differences in the above chart would reflect comparatively lower effective interest rates during the last two decades. Contrary to Jayadev and Josh Mason’s work, this outcome would support the view that low interest rates were a cause of the financial turmoil. However, this result would not place the blame primarily on the Federal Reserve but rather on a confluence of actions from the government and non-government sectors.

What are readers’ thoughts on these questions and/or my initial conclusion?

During the past week a couple of my friends and family asked whether or not I was considering buying a home in the near future. To give a quick bit of background, I’m approaching (or in) my late 20’s and was recently engaged. I’m also fairly confident in plans to live within the DC Region for at least several more years. Given all of the discussion about home values, interest rates and the American dream, I thought expressing my own views on the current housing market would be helpful.

Based on conversations and reading over the past several months, the general opinion seems to hold that the current environment is the ideal time to purchase a home. As I understand the argument, home prices have fallen significantly and appear to be bottoming. At the same time mortgage rates are near historic lows, which makes servicing debt on a mortgage relatively easier. Both of these observations suggest that now is an opportune time to buy a house. If only the decision were that simple. Deciding if now is a good time requires determining whether or not those assumptions are valid. So are they?

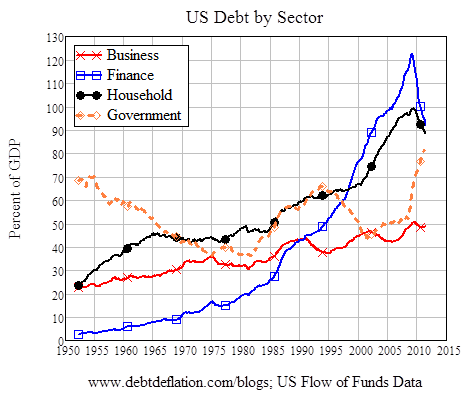

Home prices have certainly fallen significantly in the last few years, but calling a bottom seems pre-mature. Many housing analysts will note that existing home sales have been rising, the supply of homes for sale is shrinking and the number of new homes being built is well below trend. The other side of the story, which often goes untold, is that new home sales continue falling to new lows, data on existing homes for sale is distorted by a potentially large shadow inventory of homes awaiting the foreclosure process, and household debt remains at very elevated levels (see top chart below). For those who have studied previous bubbles in asset markets, prices tend to undershoot historical norms on the downside as well (see bottom chart below). Public policy, to date, has worked hard to maintain home values at elevated prices to reduce any negative wealth effect on consumer demand and prevent greater losses to banks and GSE’s holding underwater mortgages. The future direction of housing policy and home values remains extremely unclear and one cannot rule out further declines of 10%-20%.

Moving on to interest/mortgage rates, it is also true that rates are at or near historically low levels. Mortgages with 30-year fixed rates are currently being offered around 4%. Rates on mortgages generally track the interest rate on US Treasuries with similar maturities, adding a small premium for extra risk of repayment and profit. The rate on US Treasuries is basically the average of expected Fed Funds (short-term) rates over the maturity of the bond (Treasury Yields Low for Good Reason). Determining the future of mortgage rates therefore relies on predicting the future path of monetary policy. On Wednesday the Fed announced expectations that the rate will remain exceptionally low until late 2014, based on forecasts of low inflation and high unemployment. Despite the multitude of people expressing fears about inflation and belief that the Fed will need to raise rates soon (these began in 2009), I continue to hold the view that disinflation remains more prominent in the US (Deflationary Monetary Policy). Based on my outlook for the economy (Predictions for 2012), I expect the Fed to hold interest rates near 0 until at least 2015. Under the corresponding economic environment, long-term interest rates may fall further but are very unlikely to rise. Mortgage rates may very well remain at historically low levels far longer than most people today imagine.

When deciding whether or not to purchase a home, there are certainly a whole host of factors to consider that were not discussed here (family, job security, income, savings/debt, location, etc). The purpose is to provide an alternative prospective to the seemingly common perception that now is the best time to buy and those who fail to act will miss a great opportunity. While I don’t rule out that possibility, I believe the outlook for home prices and mortgage rates suggests this window of opportunity will remain open for a few years. In fact, those who wait may be rewarded with lower mortgage rates and more house for their money. There is no rush to buy a home!