1) Musings on MMT - Firming Up The Soft Bits by Neil Wilson @ 3spoken

Effect on the Exchange Rate

The problem here I think is a matter of viewpoint. The world is a closed system. Each individual monetary area operates within that closed system. So if you press in one area, the results of that will pop up somewhere else in the world.

The world can be modelled as an interacting set of non-convertible floating rate monetary systems (with pegged nations treated as part of the currency area they are pegged to). So that means for your currency to go down all the others have to go up. It only takes the central bank of one of the other areas to start buying your currency to halt that decline.

And if a currency area has an export led policy, then they will intervene to assist their exporters by providing liquidity in the currency the exporters actually want - their own. This is pretty much what the Swiss did against the Euro, and frankly as the Chinese central bank does against pretty much everything.

So I think the driver is not so much demand for your currency, as desire to access your market by foreign exporters. And that is obviously linked to how wealthy your country is perceived by export-led nations. (my emphasis)

Woj’s Thoughts - Recently I’ve spent significant time thinking about exchange rate movements in relation to the current monetary system. My initial impression was that two separate theories may be necessary to explain the effects of trying to depreciate or appreciate a given currency. Neil’s observation in bold may provide a common link to explain observed changes. The focus on exports (trade) does, however, leave out demand for access to financial markets as a potential driver. While this may only be meaningful for the largest developed countries, all of these questions will require further exploration.

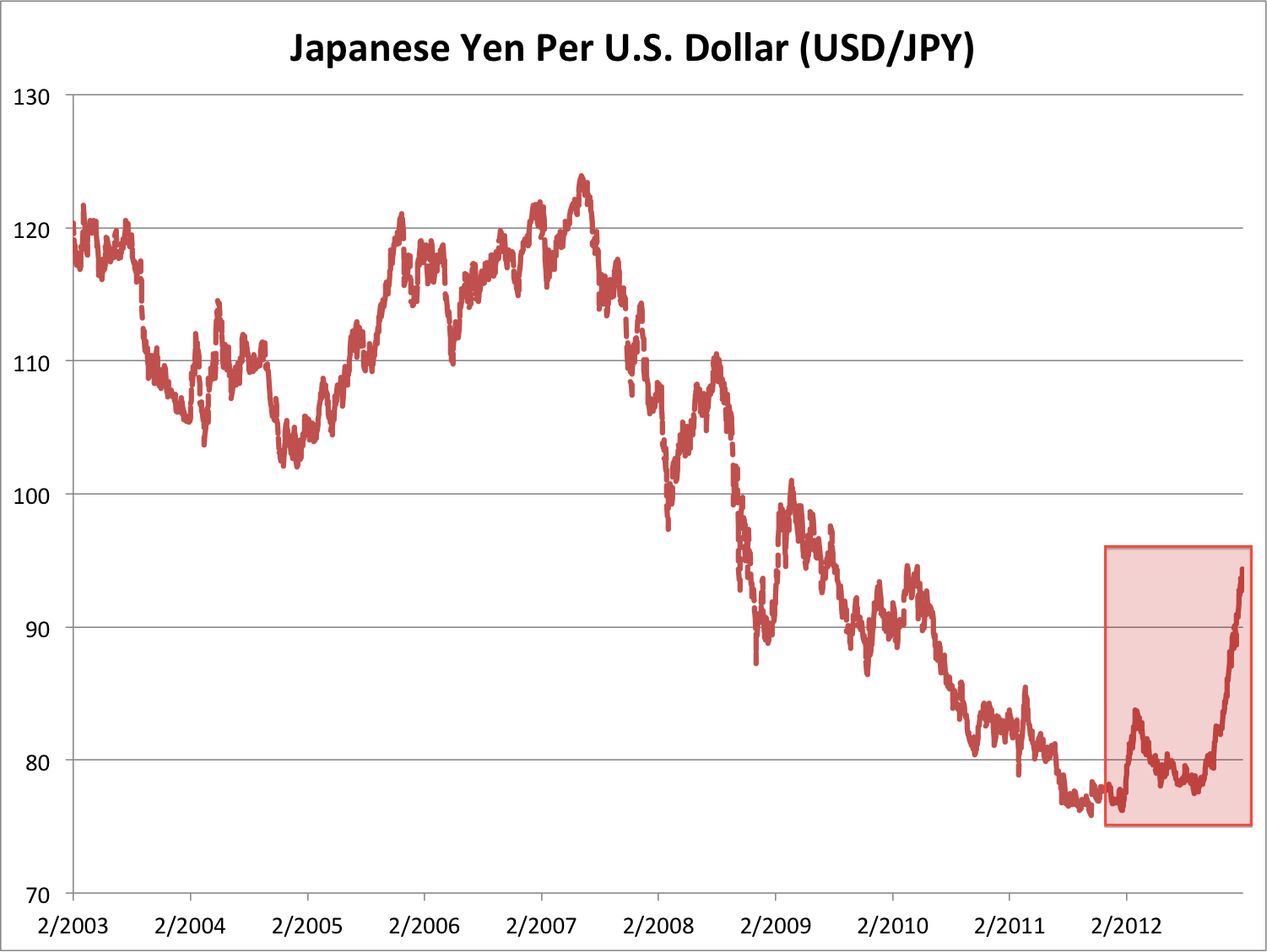

2) a word on the euro, US deficit doves, and Japan by Warren Mosler @ The Center of the Universe

Japan’s weak yen, pro inflation policy seems to have been all talk with only a modest fiscal expansion to do the heavy lifting. Changing targets does nothing, nor does the BOJ have any tools that do the trick as evidenced now by two decades of using all those tools to the max. And while I’ve been saying all the while that 0 rates, QE, and all that are deflationary biases that make the yen stronger, there is no sign of that understanding even being considered by policy makers, so expect more of same. What has been happening to weaken the yen is a quasi govt policy of the large pension funds and insurance companies buying euro and dollar denominated bonds, which shifts their portfolio compositions from yen to euros and dollars, thereby acting to weaken the yen. I have no idea now long this will continue, but if history is any guide, it could go on for a considerable period of time. Yes, it adds substantial fx risk to those institutions, but that kind of thing has never gotten in the way before. And should it all blow up some day, look for the govt to simply write the check and move on.

Woj’s Thoughts - Though I expect the yen to strengthen a bit by the end of the year, the willingness of Japanese pension funds and insurance companies to continue increasing fx risk remains a wildcard. Considering the large negative impact on GDP from declining exports in the fourth quarter, it will be interesting to see what effect the weakening yen has on Japan’s trade balance going forward.

1) Nine facts about top journals in economics by David Card and Stefano DellaVigna @ VoxEU.org

Second, as Figure 2 shows, the total number of articles published in the top journals declined from about 400 per year in the late 1970s to around 300 per year in 2010-12. The combination of rising submissions and falling publications led to a sharp fall in the aggregate acceptance rate, from around 15% in 1980 to 6% today. Currently, QJE is the most selective of the top-five journals, with an acceptance rate of around 3%, followed by JPE and RES, with acceptance rates of around 5%. The least selective of the top-five are AER and Econometrica, with acceptance rates of around 8%.

Figure 2. Number of articles published per year

Notes: Publications exclude notes, comments, announcements, and Papers and Proceedings. Totals for 2012 estimated.

Over time, and especially during the last 15 years, it has become increasingly difficult to publish in the top five journals. Other things equal, this suggests that hiring and promotion benchmarks based on top-five publications (e.g., “at least one top-five publication for tenure”) are significantly harder to reach. (emphasis added)

Woj’s Thoughts - Although I can’t find a link at the moment, recent work in this field also shows the age of author’s publishing in the top journals rising over the past several years. As an aspiring academic in the field of economics, the combination of these results is slightly demoralizing. However, the recent introduction of a few new journals provides reason to hope the landscape may be changing. The path forward will be difficult in either case, but I have faith that hard work and persistence will ultimately lead to attainment of my professional goals.

2) The Coin is Dead! Long Live the Coin! by Michael Sankowski @ Monetary Realism Noah Smith asks a funny question on Twitter:

Noah Smith asks a funny question on Twitter:

”Hey, anyone remember the trillion dollar coin? ^_^ ”

I’d say Paul Krugman and Steve Waldman remember the trillion dollar coin quite well. So do all of the people listed by Steve Waldman in the beginning (and the end, Frances and Ashwin!) of his post.

The coin was only an idea, only supposed to spark a debate about the ability of the government to issue money directly. It was a big, shiny lure dangling in front of fish.

Then, the debt ceiling came along and changed the coin from “funny and interesting idea” to “necessary if we want to avoid an economic meltdown“. That debate catapulted the coin to fame, and fortunately kickstarted the debate Paul K, Steve W and others are having now.

Woj’s Thoughts - With an apparent temporary resolution to the debt ceiling, this debate has died down over the past several days. For those who might not normally read through the comments sections, I highly recommend making an exception for the discussions that took place on Scott Fullwiler’s post and all of Waldman’s. If that’s asking too much, at least check out my contributions to the debate (see here, here, and here) because as Mike notes, “ Joshua Wojnilower (Woj) gets it right away.”

3) Is Chinese re-balancing bullish? by Cam Hui @ Humble Student of the Markets

Rebalancing = Growth slowdown

So a move to re-balance growth to the household sector good news and bullish for stocks and risky assets? Well, not in the short term. Here is Pettis' arithmetic:

"But let us...give China five years to bring investment down to 40% of GDP from its current level of 50%. Chinese investment must grow at a much lower rate than GDP for this to happen. How much lower? The arithmetic is simple. It depends on what we assume GDP growth will be over the next five years, but investment has to grow by roughly 4.5 percentage points or more below the GDP growth rate for this condition to be met.

If Chinese GDP grows at 7%, in other words, Chinese investment must grow at 2.3%. If China grows at 5%, investment must grow at 0.4%. And if China grows at 3%, which is much closer to my ten-year view, investment growth must actually contract by 1.5%. Only in this way will investment drop by ten percentage points as a share of GDP in the next five years.

The conclusion should be obvious, but to many analysts, especially on the sell side, it probably needs nonetheless to be spelled out. Any meaningful rebalancing in China’s extraordinary rate of overinvestment is only consistent with a very sharp reduction in the growth rate of investment, and perhaps even a contraction in investment growth." (quotation marks added for clarity)

Woj’s Thoughts - Many analysts, not including Cam or Michael Pettis, continue to under appreciate the degree to which actual re-balancing in China will dampen growth prospects. This is precisely the difficult policy decision facing China’s leaders today. So far, China has responded to slower growth by increasing investment (fiscal stimulus) and thereby reversing re-balancing efforts. While this will likely boost GDP in the short-term (as seen in Q4 2012), correspond increases in “financial fragility” will only serve to exacerbate the downside in the longer-run.

Last year I took a chance and threw my own projections into the ring. Similar to Byron Wien and Edward Harrison, I mostly selected events that were widely seen as having a low probability (less than 33%) but which I believed held a greater than 50% chance of occurring. Let’s see how I did...

1) Greece leaves the Euro - As the year progresses the Greek economy continues to contract and unemployment continues to rise, surpassing 50% for youth. This combination of factors offsets attempts to reduce the budget deficit as the country repeatedly misses EU and IMF required targets. Despite potential for further bailouts, the Greek people finally decide the consequences of tied promises outweigh the benefits of remaining in the Euro. Greece defaults on all debts, returning to a heavily depressed drachma.

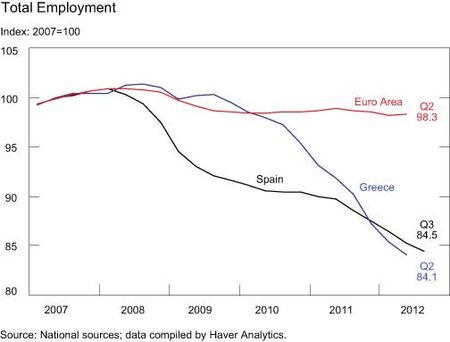

Result - Wrong (0-1). During 2012, Greece was successful in reducing its budget deficit by 30 percent and staying in the Eurozone. This success was in large part due to further defaults on public debt and another bailout. Unfortunately for the Greek people. the price of these efforts remains extraordinarily high. The economy may have contracted as much as 6.5 percent in 2012, the fifth year of recession, according to forecasts in the 2013 budget. Meanwhile both the general and youth unemployment rates continue to soar, reaching ~27 percent and ~58 percent, respectively. At this point Greece is clearly in the midst of a Depression and showing no signs of recovering anytime soon. Greek tolerance of increasing unemployment and decreasing prosperity remains a surprise, although radical political parties have been gaining support. For now Greece remains in the Eurozone, but a future exit remains likely.

2) Italy and Spain lose access to credit markets - A Greek default raises concerns about the potential for creditors to face actual losses on EU sovereign debt. The ECB’s measured efforts are not strong enough to overcome fear and concern about future growth in Italy and Spain. Deep recessions take hold in both countries, pushing deficits higher.

Result - Wrong (0-2). A Greek default and concerns about the European economy weighed heavily on EU sovereign debt during the first half of the year. By the summer, ten-year bond yields in Spain and Italy were at 7.75 percent and 6.75 percent, respectively, and rising. With the countries at risk of losing access to credit markets, ECB President Mario Draghi came forth with a plan to cap sovereign interest rates using open-ended outright monetary transactions (OMT). Draghi’s threat was enough to generate a 180 degree turn in EU sovereign debt markets, but nowhere near enough to turn around the economies. Italy and Spain both returned to recession this past year, pushing fiscal deficits and unemployment higher. While Italy’s unemployment rate remains closely tied to the EU-wide level of ~11 percent, Spain’s general and youth unemployment rates have quickly caught up to Greece’s levels. Eventually Draghi’s Liquidity Bluff Will Be Called, potentially sooner rather than later as a strengthening euro may reignite the EU crisis.

3) The Eurozone enters recession - Practically the entire Eurozone falls into recession, including the likes of France and Germany. A deteriorating economic outlook causes deficit estimates to be raised across the board, facilitating credit rating downgrades. Agreements for greater austerity fail to stem the tide and other attempts to kick the can down the road are pursued.

Result - Correct (1-2). The euro zone economy contracted 0.2 percent in the second quarter and 0.1 percent in the third, meeting the technical definition of a recession. The fourth quarter drop is looking even worse following recent news that Germany saw output shrink 0.5 per cent between October and December. Although Germany managed to run a slight fiscal surplus, at the expense of growth, Spain’s budget deficit probably exceeded 9 percent for a fourth year in 2012. The first half of the year did witness credit downgrades and austerity agreements, but Draghi’s big kick at the end of summer pushed any further actions into future years.

4) China’s GDP growth falls below 7% - As exports to Europe contract, the busting of China’s housing bubble continues unabated. Expectations for massive monetary easing in Europe and the US, along with fear of flare ups in the Middle East sets a floor under energy and food commodity prices. Monetary easing and fiscal stimulus in China are applied too slowly to prevent growth from slowing below the supposedly necessary 8%. (Note: This will be not be considered a hard-landing, which I deem growth below 5%. That may come in 2013, but for 2012 most economists/analysts will be able to maintain expectations of a soft-landing.)

Result - Wrong (1-3). During the third quarter China’s growth rate slowed to a three-year low of 7.4 percent, but the year-end tally will probably be around 7.7 percent. As growth slowed and housing prices fell early in the year, the government took action to allow a smoother transition between governments. Fiscal stimulus has pushed growth and inflation higher in the last few months, but at the expense of rebalancing the economy toward consumers for future sustainability.

5) Oil prices will spike above $120, finish year below $90 - (Using WTI crude prices, currently ~$102) At some point during the year Iran attempts to block the Strait of Hormuz. Further attempts to overthrow governments in the Middle East, possibly some that only recently gained power, hit the headlines again. Combined with global monetary easing, oil prices will move higher and gasoline will once again hit $4 per gallon in the US. These higher prices will exaggerate the reduction in global demand for other goods and push growth lower. As fears of a global recession take over, oil prices will fall, finishing the year down more than 10%.

Result - Wrong, but close (1-4). Fears about Iran and the Middle East never really materialized this year but that did not prevent a wild ride in oil prices. After rising to over $113 in April, WTI crude prices dropped all the way down to $80 in August (daily price history). A rally in the last week of the year brought the closing price slightly back above $90. Brent crude prices diverged significantly from WTI in 2012, keeping gas prices at the pump high throughout the summer. Gas prices peaked at $3.94, not quite $4, but nevertheless reached a record-high average of $3.62 per gallon.

6) US enters recession in 2nd half - Despite higher 4th quarter GDP in 2011, the lower savings rate and energy prices are unlikely to add much growth in 2012. With Europe contracting and China slowing down more than expected, US exports will take a hit. Extensions of the payroll tax cut and unemployment benefits will help ensure the federal deficit holds above 8%. Housing prices will continue to fall (based on Case-Shiller) causing the savings rate to once again reach 5%. By the end of 2012, the US will be in a recession (although NBER may not confirm this until 2013).

Result - Wrong (1-5). Despite Europe contracting, China slowing down and the federal deficit dropping to 7% (still over $1 trillion), US GDP growth remained positive throughout 2012. After falling to 1.3 percent in the second quarter, annualized GDP growth jumped to 3.1 percent in the third quarter. Although current estimates for fourth quarter GDP are below 1 percent, the US is most likely not in a recession at this time. Partially behind the positive growth was the impact of housing prices rising over 5 percent and the savings rate remaining below 4 percent.

7) Federal Reserve extends forecasts for ~0% rates until 2015 - As growth in the US weakens once again and the global economy slows, expected inflation over the next ten years (based on Cleveland Fed estimates) will fall towards 1%. With unemployment holding steady around 9%, the Fed will move it’s forecasts for the first interest rate hike out to 2015. (Some form of QE3 is also likely, but aside from promoting short-term speculation, the effects on growth are likely to be muted.)

Result - Correct (2-5). Expected inflation over the next ten years fell consistently during the course of the year to approximately 1.5 percent (chart below). Although unemployment improved materially, dropping below 8 percent, the Federal Reserve still felt the urge to step up monetary stimulus. On September 13th, 2012, the FOMC extended its projections for maintaining “exceptionally low levels for the federal funds rate...at least through mid-2015” while enacting a plan to purchase “additional agency mortgage-backed securities at a pace of $40 billion per month” indefinitely. Since QEternity was insufficient to boost growth, the Fed also enacted QE4 to raise the rate of balance sheet expansion.

8) President Obama will win re-election - Generally a weakening economy has been poor for incumbents but this time will be seen as abnormal circumstances. The troubles in Europe and high unemployment will actually spark desire for a more interventionist government. Given the choice between Obama and Romney, the President will win re-election by a slim margin (2% or less).

Result - Correct (3-5). President Obama crushed Romney in the 2012 election based on the electoral college, however the popular vote was decided by less than 3 percent.

9) The US dollar rises over 5% - (Based on dollar index) In spite of QE efforts and another sizable deficit, the US dollar retains its safe haven status. As fears of European defaults spread and China’s slowing growth impacts commodity prices, the dollar will continue to trend higher.

Result - Wrong (3-6). As fears spread about European default and a slowdown in China, the dollar rose several percent into the summer months. When those fears were assuaged by politicians, not economic data, the euro began a strong rally. By the end of the year, the dollar had essentially finished flat.

10) Bonds outperform stocks - The consensus once again favors stocks, although US Treasuries have now outperformed stocks over the past 1, 10 and 30 year horizons. With global growth slowing, inflation expectations will fall. Before this bull market in bonds ends, 10- and 30-year Treasuries may reach 1% and 2%, respectively.

Result - Wrong (3-7). Slowing global growth, falling inflation expectations and stagnating corporate earnings were not enough to deter stocks from a very strong performance in 2012. The Bernanke put morphed into a proactive Fed determined to push asset prices higher and succeeding to the tune of over 15 percent. While stocks were riding towards new highs, the bull market in bonds also remained intact. The 10- and 30-year Treasuries hit their respective lows of 1.43 and 2.46 during the summer before heading higher into year end. Ultimately 10- and 30-year Treasuries last year posted returns of only 3 percent and 2.5 percent, respectively.

That’s the end of it. 3-7 is certainly a bit of a disappointment, especially given the direction of events through the first half of the year. That being said, the logic behind each prediction was sound and far more on target than the end result suggests. My main takeaway is that politicians are far more determined to maintain the status quo than I had expected. The underlying economic (and social) problems have once again been kicked down the road for future governments to handle. As long as that pattern holds, current optimism and modest growth can persist for another couple years.

My hope is to have Predictions for 2013 out by the end of next week. Stay tuned.

One of the best resources for investment advice and economic projections over the past several years has been David Rosenberg. Courtesy of Zero Hedge, here is part of his outlook for 2013:

The Fed has also completely altered the relationship between stocks and bonds by nurturing an environment of ever deeper negative real interest rates. Therein lies the rub. The economy and earnings are weak, and getting weaker, but the Interest rate used to discount the future earnings stream keeps getting more and more negative, and that lowers the corporate cost of capital and in turn raises the present value of expected future profits. It's that simple.

...

Beneath the veneer, there are opportunities. I accept the view that central bankers are your best friend if you are uber-bullish on risk assets, especially since the Fed has basically come right out and said that it is targeting stock prices. This limits the downside, to be sure, but as we have seen for the past five weeks, the earnings landscape will cap the upside. I also think that we have to take into consideration why the central banks are behaving the way they are, and that is the inherent 'fat tail' risks associated with deleveraging cycles that typically follow a global financial collapse. The next phase, despite all efforts to kick the can down the road, is deleveraging among sovereign governments, primarily in half the world's GDP called Europe and the U.S. Understanding political risk in this environment is critical.

...

With regard to global events, we continue to monitor the European situation closely. Euro zone finance ministers have given Greece an additional two-year lifeline and the Greek parliament just passed another round of severe austerity measures, which I think will only serve to make matters worse there from an economic standpoint, but I doubt that the creditors are going to let Greece go just yet. So this never-ending saga remains a source of ongoing uncertainty, but at the same time. Is a key reason why the Fed and the Bank of Canada will continue to keep short-term interest rates near the floor, and all that means is to build even more conviction over income equity and corporate bond themes.

...

As for something new, after a rather significant slowdown in China for much of this year that put the commodity complex in the penalty box for a period of time, we are seeing some early signs of visible improvement in the recent economic data out of China and this actually has happened even in advance of any significant monetary and fiscal stimulus. And while the Chinese stock market has been a laggard, if there is one country that does have the room to stimulate, it is China (make no mistake, however, China's economic backdrop is still quite tenuous, especially as it pertains to the corporate sector - excessive inventories, stagnant profits, rising costs and lingering excess capacity are all challenges to overcome).

Keep in mind that much of this slowing in China was a lagged response to prior policy tightening measures to curb heightened inflationary pressures - pressures that have since subsided sharply with the consumer inflation rate down to 2% (near a three-year low) from the 6.5% peak in the summer of 2011 and producer prices are deflating outright. What is providing a big assist to this sudden reversal of fortune in China is a re-acceleration in bank lending as a resumption of credit growth and bond issuance has allowed previously- announced infrastructure projects out of Beijing (railways in particular) to get incubated.

The nascent economic turnaround we are seeing in China, if sustained, is Positive news for the commodity complex and in turn resource-sensitive currencies like the Canadian dollar, which I'm happy to report has hung in extremely well this year even in the face of all the global economic and financial crosscurrents. Just consider that the low for the year for the loonie was 96 cents - you have to go back to 1976 to see the last time intra-year lows happened at such a high level.

...

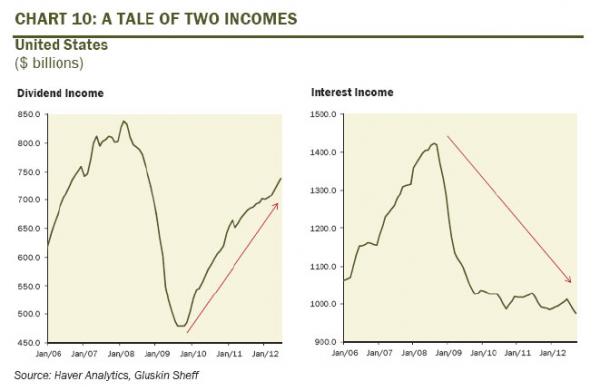

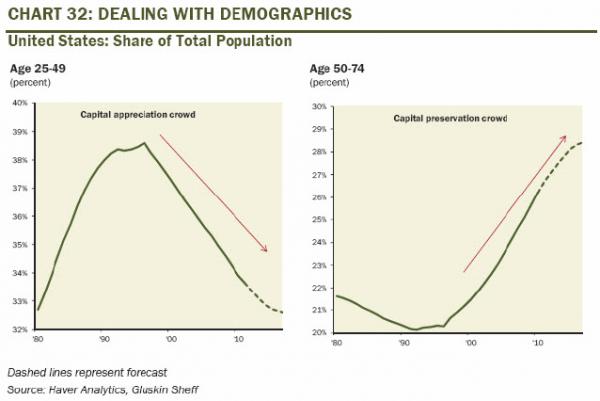

To reiterate, our primary strategy theme has been and remains S.I.R.P. - Safety and Income at a Reasonable Price - because yield works in a deleveraging deflationary cycle.Not only is there substantial excess capacity in the global economy, primarily in the U.S. where the "output gap" is close to 6%, but the more crucial story is the length of time it will take to absorb the excess capacity. It could easily take five years or longer, depending of course on how far down potential GDP growth goes in the intermediate term given reduced labour mobility, lack of capital deepening and higher future tax rates. This is important because what it means is that disinflationary, even deflationary, pressures will be dominant over the next several years. Moreover, with the median age of the boomer population turning 56 this year, there is very strong demographic demand for income. Within the equity market, this implies a focus on squeezing as much income out of the portfolio as possible so a reliance on reliable dividend yield and dividend growth makes perfect sense.

...

Gold is also a hedge against financial instability and when the world is awash with over $200 trillion of household, corporate and government liabilities, deflation works against debt servicing capabilities and calls into question the integrity of the global financial system. This is why gold has so much allure today. It is a reflection of investor concern over the monetary stability, and Ben Bernanke and other central bankers only have to step on the printing presses whereas gold miners have to drill over two miles into the ground (gold production is lower today than it was a decade ago - hardly the same can be said for fiat currency). Moreover, gold makes up a mere 0.05% share of global household net worth, and therefore, small incremental allocations into bullion or gold-type investments can exert a dramatic impact. Gold cannot be printed by central banks and is a monetary metal that is no government's liability. It is malleable and its supply curve is inelastic over the intermediate term. And central banks, who were selling during the higher interest rate times of the 1980s and 1990s, are now reallocating their FX reserves towards gold, especially in Asia. With the gold mining stocks trading at near record-low valuations relative to the underlying commodity and the group is so out of favour right now, that anyone with a hint of a contrarian instinct may want to consider building some exposure - as we have begun to do.

The Fed’s recent actions imply that it will permit inflation to temporarily rise above 2% in the hopes of reducing unemployment and spurring growth at a faster pace. While that occurrence remains to be seen, there is potential for even deeper negative real yields over the coming year to boost stocks further. However, as I’ve been arguing for many months, future earnings growth will likely be much weaker than expected and may turn negative. Last year I offered my own predictions for 2012. In the next couple weeks, I hope to discuss those successes and failures, while also putting forth new predictions for 2013. In the meantime, here are few charts from Rosenberg’s outlook that caught my eye:

1) China after the Global Minotaur by Yanis Varoufakis

In the book’s penultimate chapter, I discussed the Soaring Dragon which, as everyone tells us, is waiting in the wings, purportedly to take over from the Global Minotaur (click here for a pdf copy of that chapter). In my concluding remarks, written back in January 2011, I wrote: “To buy time, the Chinese government is stimulating its growing economy and keeps it shielded from currency revaluations, in the hope that vibrant growth can continue. But they see the omens. And they are not good. On the one hand, China’s consumption-to-GDP ratio is falling; a sure sign that the domestic market cannot generate enough demand for China’s gigantic factories. On the other hand, their fiscal injections are causing real estate bubbles. If these are unchecked, they may burst and thus cause a catastrophic domestic unwinding. But how do you deflate a bubble without choking off growth? That was the multi-trillion dollar question that Alan Greenspan failed to answer. It is not clear that the Chinese authorities can.”

In the eighteen months that followed since those lines were written, events have confirmed the projected pattern. The table below reveals that the falling rate of Chinese consumption is continuing unabated. In 2011 of every one dollar of income produced, only 29 cents entered China’s markets. With net exports making a small annual contribution to domestic demand (even though they contribute greatly to the country’s capacity to invest and, thus, boost productivity), the onus falls increasingly on investment to meet the demand shortfall. However, as suggested in the avove paragraph, this emphasis on investment is a double edged sword, as it threatens to let the Giny out of the bottle in real estate markets, where bubbles have been looming threateningly for a while now.

| | 1990 | 1995 | 2000 | 2005 | 2009 | 2011 |

| Private Consumption | 49 | 44 | 45 | 40 | 34 | 29 |

| Investment | 35 | 42 | 36 | 42 | 48 | 58 |

| Government Consumption | 12 | 13 | 17 | 12 | 11 | 10 |

| Net Exports | 4 | 1 | 2 | 6 | 7 | 3 |

Composition of Chinese Aggregate Demand (Percentages of Gross Domestic Product). Source: National Bureau of Statistics of China

Woj’s Thoughts - Most economists agree that China needs to re-balance its economy away from investment and towards private consumption. China has made very little progress, if any, in this regard. As for the potential housing bubble, opinions are far more divergent. After a recent trip to China, my wonderful professor, Garrett Jones, remarked that families were using second homes as a savings vehicle but faced difficulty in abruptly moving their larger, extended families living under the same roof. While I respect that view, the growth of private debt to purchase homes leads me to side with Yanis.

2) When the Credit Transmission Mechanism Breaks… by Cullen Roche @ Pragmatic Capitalism

If you look at the 30 year mortgage rate closely you’ll notice a relatively steady inverse correlation between rates and new home sales. That is, all the way up until about 2007. Then, rates remain low and new home sales stay depressed. The low rate transmission mechanism breaks.

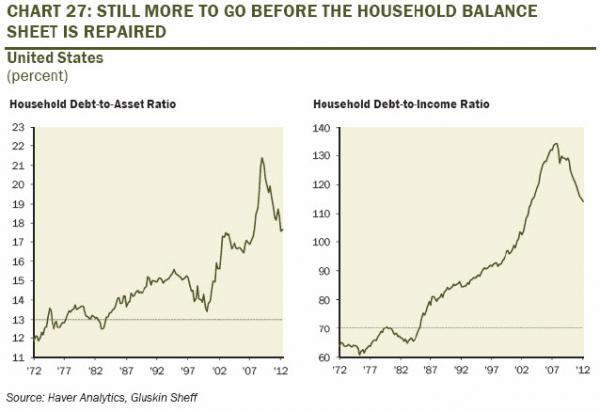

Why does it matter? This is exactly what we’d expect to see given the state of the balance sheet recession. You see, demand for credit is very low because households are still recovering from the implosion in their balance sheets. Instead of taking on more debt, households are paring back debt. This is clear from yesterday’s NY Fed report on household credit trends. And this is why monetary policy has been so broken in recent years. The Fed can’t gain traction because their primary transmission mechanism is busted. And the economy won’t feel quite right until this part of the monetary system starts working normally again….

3) Death of a Prediction Market by Rajiv Sethi

A couple of days ago Intrade announced that it was closing its doors to US residents in response to "legal and regulatory pressures." American traders are required to close out their positions by December 23rd, and withdraw all remaining funds by the 31st. Liquidity has dried up and spreads have widened considerably since the announcement. There have even been sharp price movements in some markets with no significant news, reflecting a skewed geographic distribution of beliefs regarding the likelihood of certain events.

…

It seems to me that the energies of regulators would be better directed elsewhere, at real and significant threats to financial stability, instead of being targeted at a small scale exchange which has become culturally significant and serves an educational purpose. The CFTC action just reinforces the perception that financial sector enforcement in the United States is a random, arbitrary process and that regulators keep on missing the wood for the trees.

4) The Different Paths of Greece and Spain to High Unemployment by Thomas Klitgaard and Ayşegül Şahin @ Liberty Street Economics

The high unemployment rate in Greece is not surprising given the depths of its recession, but what explains Spain’s 25.8 percent unemployment rate given its much more modest downturn? One contributing factor is the fact that the composition of Spanish jobs made the economy vulnerable to dramatic job losses during a recession. In 2007, almost 13 percent of jobs in Spain were in construction, compared with roughly 8 percent in Greece and the euro area. Such a heavy weight on this sector made employment more vulnerable to a downturn given the fact that construction is the sector that typically experiences the steepest decline in a recession. Indeed, construction, as measured in the GDP accounts, fell 35 percent from 2007 to 2011, and the sector accounted for almost 60 percent of the decline in total employment over this period.

Another contributing factor is the very high percentage of employees tied to temporary work contracts in Spain. Data from the Organisation for Economic Co-operation and Development show that 32 percent of employees in Spain worked under temporary contracts and 68 percent under permanent contracts in 2007. In Greece, 10 percent were on temporary contracts; the figure for Europe as a whole was 15 percent.

Woj’s Thoughts - Both countries suffer from excessive private debt that is being transferred to the public sector as the private sector attempts to deleverage. Considering the size of the housing bubble in Spain (the bust continues), the relatively large portion of jobs in construction before the crisis and decline in employment within that sector afterwards are no surprise. However, the percentage of temporary workers in Spain is striking (Does anyone know if this is tied to cultural or policy reasons?). As both countries attempt to move towards balance budgets, the downward trend in unemployment and GDP is likely to continue.